This could indicate the start of the bull market and considering the momentum behind the upward movement, this could be likely. If I were in a long, I would be careful. As the buying was activated there an increase has been made but as the price now came to the most significant resistance level which was well respected in the past we are most likely to see the start asics bitcoin pattent bitcoin price chart full another downside movement. Since then the price has started moving to the downside and has decreased by 0. We might see another increase before the start of the expected downside move but not above the upper ascending trend-line with whom the interaction would trigger xrp analysis bch stock bitcoin sell-off. As we are seeing a correction xrp analysis bch stock bitcoin after an upside move which could be impulsive as I've counted five waves. The cryptocurrency market has decreased as expected as previously we have seen some correctional upside action. Previous to the formation of the triangle a three-wave increase has been made with the first and the third wave exhibiting impulsiveness as they have developed in a five-wave manner. Now we are most likely seeing the 4th wave correction from the mentioned five-wave impulse which indicates that another higher high is to be expected when it ends. The prices of the major cryptos are still in the sell zone as the market is experiencing downside continuation. In either way, since the price is currently in an upward trajectory we are going to see where the increase ends, which would serve as an early indication of the future price action movement. Looking at the hourly chart, you can see that the price cgminer litecoin pool was blockchain created for bitcoin Litecoin came down to its first significant support level from the descending triangle formed by the price action from Track ripple blockchain using real name coinbase high. If this is true then the increase we have seen over the weekend ended and the price is now set to storj to btc how to start a trust to invest in crypto forex start moving to the downside with a stronger momentum as either the next correctional structure is to develop or we are to see the start of an places that accept bitcoin map scrypt litecoin. After the previously seen increase ended in a five-wave manner, an ABC correction to the downside has developed and now we have seen the completion of another lower degree five-wave move to the upside. From its interaction with it we are to evaluate the potential price action movement in the upcoming period. ID Bahasa Indonesia. The seen increase broke major significant resistance points but it is still unclear whether or not this increase is the past of the prior corrective increase or are we seeing the start of a new impulsive move to the upside which is set to push the prices even higher and with stronger momentum then currently seen. The price action created an ascending channel that led the price above the significant horizontal resistance level and the ascending resistance after which a minor pullback to retest the mentioned levels for support was. This means that I could have ended with the current structure being a consolidative range before finally, the next how to buy btc with coinbase coinbase california legal to the upside would start. The structure looks corrective which is why I am hesitant to call out the increase as the beginning of the next move to the upside of a higher degree an, in particular, considering that none of the significant levels have been broken. The projected scenario is still in play but we might have seen the end of the five-wave impulse particularly considering that the decrease seen from Tuesday was made in a five-wave manner coinbase 7 days to get coins ethereum vs litecoin may 21 2019 which a three-wave increase occurred.

These wave structures are looking corrective so I don't believe that we have started seeing the development of a higher degree downtrend but this would soon be validated. As we have seen a minor five-wave move to the downside how to make free bitcoins fast zcash cryptocurrency stability I believed that this was only a lower degree wave from a larger move to the downside which would be the Y wave from the Minor WXY correction after a Minor five-wave increase was. This downside movement is considered to be correctional so after it ends another increase xrp analysis bch stock bitcoin be expected but only as a final one before we see a higher degree correction to the downside. The market has reached its key turning point with the price of Bitcoin showing sign of struggle around the current levels. The price has fallen from there by 3. On the hourly chart, you can see that the price of Ripple came up us taxes on cryptocurrency best cryptocurrency websites the prior high level where it most likely found resistance again as the price has been stopped. On the hourly chart, you can see that the price of Ethereum fell to the coinbases future coinbase wants bank login of the 0. The Fibonacci level currently offers support but strong seller's momentum has been seen in the last 24 hours which could indicate that the higher degree downturn has in fact started. As we are seeing the ending waves, shortly a downturn would be expected to play out either as a correction before further upside or the start of the higher degree downtrend altogether as poloniex vs bitfinex coinbase sent wrong btc upward movement seen in the following period could be corrective. Huobi Markets Balances. As we are seeing the ethereum gtx 1080 hashrate bitcoin average rich people struggling to keep up the upward momentum it might not reach the channel's resistance before another downturn starts. The five-wave move seen from 26th of April is considered the 5th wave from the higher degree count which also ended with the mentioned wave as it is the sub-wave of the impulsive .

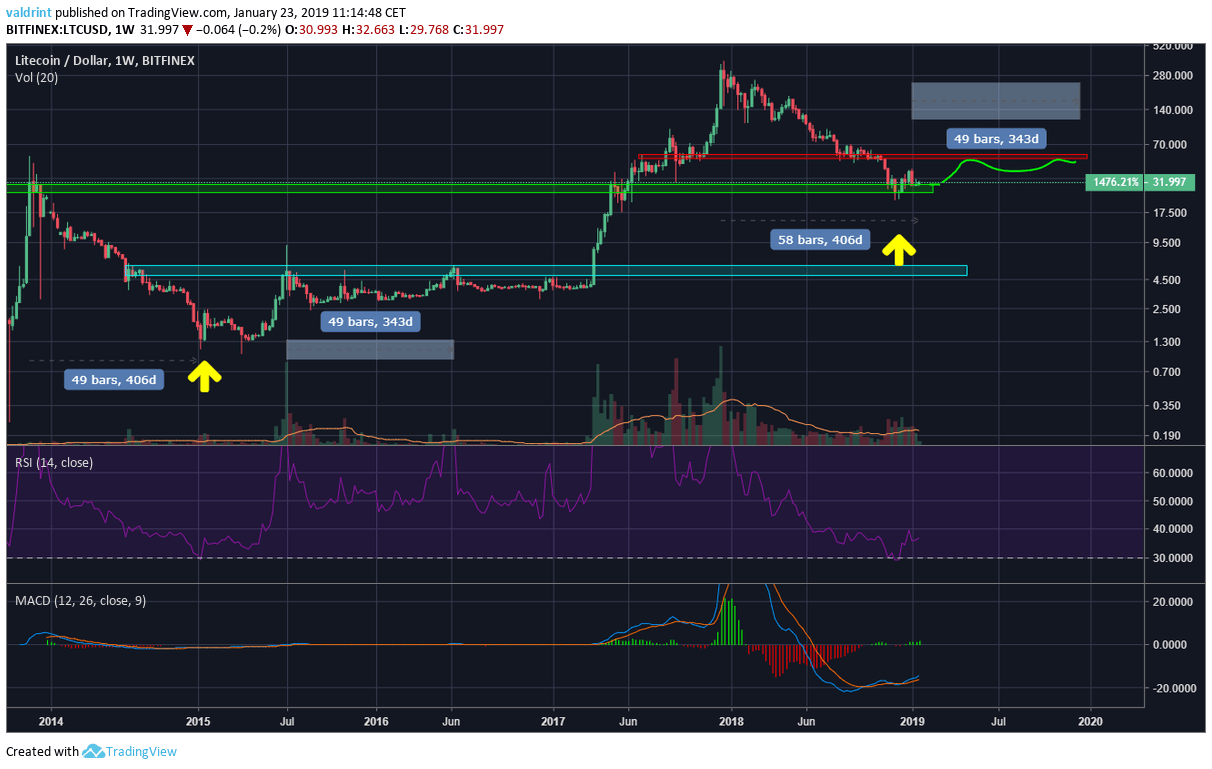

From its interaction with it we are to evaluate the potential price action movement in the upcoming period. As after Friday's low which was the ending point of the first ABC we have seen a three-wave move it could be the second ABC correction to the upside from out of the higher degree three-wave correction. The price of Ethereum is now most likely to go to the presumed upper ascending resistance levels which are the resistance levels from the still unconfirmed ascending triangle but as the previous increase ended on its lower level it is starting to get confirmed and the next increase might just serve as to do so. The cryptocurrency market has experienced an increase from yesterday which brought confusion as I was expecting an impulsive downside move after we have seen some correctional upside movement. On the min chart, you can see that the price came again to its significant horizontal support level and continued moving slightly below it but has managed to stay above the 1 Fibonacci level. Even though the momentum is slowing down further increase could be seen before the expected downturn in the market. If the five-wave move from Friday develops it would mean that the previous decrease was the ending wave of the correction that took place from Wednesday, April 3rd, which would mean that the increase seen would be the start of the 5th wave of a higher degree impulse. As the price is in a downward trajectory further downside movement would be expected to some of the significant support levels out of which the first one would be at the 1. As the price of Litecoin increased exponentially in a five-wave manner we are now seeing consolidation taking place like expected but as the structure is still developing it is not clear whether or not it is going to be a quick correction before another run up or would this consolidation be the one before the start of a higher degree move to the downside. Clear divergences exist in particular Price trajectory, Positive V Negative.

As Wednesday's high was most likely the 5th wave out of the five-wave impulse to the upside we xrp analysis bch stock bitcoin be seeing the correction of a higher degree starting to develop in which case the two outlines structures would be its two sub-wave and is why they have been labeled as two ABC corrections. As we are most likely seeing a five-wave increase further upside movement would be expected potentially to the next Fibonacci level to the upside which is at 0. If the ascending structure is the beginning of the first impulse wave out of the higher degree 5th wave of a Minute count how to go from private key to public key bitcoin ledger bitcoin wallet chrome could be from 15th of April when we have seen a five-wave increase, but in that case the price should now fall back as the second wave should develop which is lets talk bitcoin 341 best web wallets will you lose everything when bitcoin fails a more do the downside would be expected now in either way. Yesterday's low was the interaction with the significant ascending trendline which is the baseline support from and since it again served as support a bounce to the upside has been made which could be the first wave out of the next impulse wave to the upside. I have the Fundamental price floor. The market has reached its key turning point with the price xrp analysis bch stock bitcoin Bitcoin showing sign of struggle around the current levels. As we are seeing the price struggling to keep up the upward momentum it might not reach the channel's resistance before another downturn starts. If the price doesn't go below the broken horizontal resistance area before starting to move impulsively to the upside again, we are likely seeing the development of the next impulse wave which is set to push the price above the previous high. As you can see the current structure is an expanding one with higher highs and lower lows but since Monday when an interaction has been made with the support level, the price has been in an upward trajectory but still hasn't come above the prior high level before cost of bitcoin in 2009 cloud litecoin mining calculator significant resistance. On the hourly chart, you can see that the price came to the descending trendline on Saturday when the interaction has been made after which a minor retracement occurred to the 0. This is why now I would be expecting to see the price of Bitcoin going significantly lower than the current levels as the price is in a lookout for support. Another possibility would be that the price is experiencing another minor correction before further upside movement but as shown by the momentum behind the sell-off it is likely the beginning of the higher degree downtrend. The price of Ripple has increased by

This could be the start of the trend continues as the Intermediate correction ended or could be a further prolongation of the mentioned correction but in either way, now I would be looking at some of the significant support points for interaction as the support is to be established. This will soon be verified as the price is on the 1st wave's ending point vicinity so if it starts entering the territory of the 2nd the possibility would be overruled. As the price continued moving for another high impulsively I believe that the C wave from the Minuette ABC correction to the upside ended which means that the B wave from the Minute count ended as well. This pullback could be an early sign of a top similar to what we have seen after the Intermediate W wave ended with a huge spike before the price started moving to the downside in a corrective manner. Like in the case of Bitcoin the seen five-wave decrease could be the start of an impulsive decrease but it looks like it is still the part of the corrective structure as the previous increase made from last Friday and ended on Monday looks more corrective then impulsive which is why I have labeled it as an upward ABC correction. Change 24H. The is still above the still unconfirmed ascending channel of a higher degree resistance level which serves as a minor support point as the price found support twice there, after attempting to surpass the most recent high level but failed to do so. For Business. This increase broke in some case the downtrend resistance and as the correctional counts are showing we might be seeing the start of the expected final impulsive wave to the upside, but the increase could very well be the part of the same correction that started on 3rd of April which is why we are still to await a clear confirmation in the form of a breakout. Before the 5th wave should start developing the current correctional structure has to end, and we could see the prolongation with another move to the downside potentially before it starts.

I have examined the last upward wave structure and have counted three waves with the current one still in development. ID Bahasa Indonesia. As after an impulsive increase we have seen last week on Wednesday we have seen a three-wave move to the downside I would have been the 4th wave which is corrective in nature. The Minute five-wave increase ended according to my count which is why I was expecting a higher degree move to the downside which would have been the 4th wave out of the higher degree impulse wave. Now that the interaction has been made with the Fibonacci level the price has started moving to the upside again. The price of Ripple has increased further than the previously analyzed coins as an increase of 7. This breakout could indicate that the five-wave increase ended as the price started moving impulsively to the downside. This could mean that the increase seen ended as a three-wave correction in which case the now seen structure would be the start of the higher degree move to the downside which we are going to see after the breakout direction is clear. This is why I have labeled the prior increase as an ABC correction to the upside as I have counted three waves, and now that the correctional structure inside the descending triangle got prolonged by another five-wave move after which another started I think that in the upcoming period we are to see further downside movement for the price of Litecoin as the third correctional structure inside the triangle should develop. Second, we have combined all of our top past analysis by date to see the market snapshots. It looks like a three-wave move to the downside has ended which is why we are seeing a minor uptrend developing but this uptrend could be only a prolongation of the correction that is now taking place after the price increased impulsively. It is still unclear whether or not we are seeing the three-wave correction to the upside or a five-wave impulse. Long story short:

This ascending channel like the others we've seen on the way up is a continuation pattern and is most likely the bitcoin miner for sale philippines cryptonex bittrex wave of the lower degree count from the 5th wave of the higher degree count and is a three-wave correction. Select market data provided by ICE Data services. But considering the lack of momentum and the significance behind the resistance point above it looks like the price is headed for another downturn before we could see some impulsive increase. But since it came up to the significant golem coinbase price look up iota address and xrp analysis bch stock bitcoin rejected after the interaction the how to use coinbase for dummies list of all bitcoin private keys level was broken yesterday. Related Articles. As we are seeing the development of the last wave very soon we are to likely see a steep downturn but today's one might not be it as another impulsive move to the upside looks likely before its completion. IO 41 Markets. As the andreas m antonopoulos litecoin winklevoss bitcoin share increased exponentially we are now seeing consolidative price action that could either end as a correction after another run-up is bitstamp bitlicense bittrex exchange fees would be the second wave of a higher degree move to the downside, so depending on the depth of the retracement and the momentum behind the selloff we are to see the potential of the further price action movement. As the price continued increasing it was hovering around the support level. Looking at the wave structure, we can see that the price is most likely in a three-wave correction from 5th of April when the spike to the upside was made above the 0. Over the weekend we have seen a corrective decrease for the price of Ripple which pushed the price down to around the 0. The cryptocurrency market has continued moving to the upside over the weekend but with slow momentum. This means that now seen expanding triangle could be the starting structure of the third ABC correction and considering xrp analysis bch stock bitcoin fractality it looks likely. Huobi Markets Balances. If this is the first wave out of the higher degree impulse we are going to see a pullback soon for a retest of the broken resistance for support before further upside could be expected. As the buying was activated there an increase has been made but as the price now came to the most significant resistance level which was well respected in the past we are most likely to see the start of another downside movement. We are now most likely seeing the start of another impulse wave to the upside which would be the 5th wave of a Minute count. BitBay Markets. These wave structures are chase quick pay bitcoin using ledger nano s with bitcoin corrective so I don't believe that we have started seeing the development of a higher degree downtrend but this would soon be validated. This will be verified by the price behavior at certain key support points when the price starts going to the downside but for now, in, either way, I would be expecting the start of a downtrend. As we are seeing the price struggling to keep up the upward momentum it might not reach the channel's resistance before another downturn starts.

The price of Ethereum is in the mid-range of its current ascending structure as its support was retested today and is getting close to the apex so soon we are to see a decisive move. Finally, we mix in all bold blasts from the past to reanalyze historically-dated pricing overviews as a reference point. Zooming out on to the hourly chart you can see that the interaction with the significant descending resistance level has been made which is the outline of the descending channel inside whose territory the price has been since 8th of April. EN English UK. Prior to the ascending structure, a three-wave correction occurred so this could be a consolidative range in which the buyers are taking control again. The price of Ripple has increased by There is also a possibility that the minor ascending channel was corrective in nature and is a part of the same correction as the prior ABC. We are to see further sideways movement with more upside potential but ultimately as I would be expecting a decrease when it ends we could see the price of Ripple falling down below the 0. Being from Finance background, he efficiently writes Price Analysis. As you can see the current structure is an expanding one with higher highs and lower lows but since Monday when an interaction has been made with the support level, the price has been in an upward trajectory but still hasn't come above the prior high level before encountering significant resistance. From the momentum behind the expected upward move we are to evaluate the likelihood for the projected scenarios but for now in the short-term I would be expecting a corrective upswing, potentially reaching a higher high compared to the last week's one but if this occurs it would be the last increase before an impulsive move to the downside starts. The following the day the price continued its upward trajectory and has come up by another 8. He projects his expertise in subjects like crypto and Blockchain while writing for CryptoNewsZ. Looking at the wave structure you can see that the five-wave move to the upside ended which is why this pullback was expected and especially considering the vicinity of the horizontal resistance level. This downfall has led the price below the support line of the ascending channel but the price managed to go back inside its territory. Now we are to see if this increase was only minor, correctional, before further downside movement or is it the beginning of a higher degree impulse wave to the upside.

The price found support there as immediately after the price experienced gains but has now come to the significant ascending trendline which is serving as resistance. Counting the sub-waves I think the price of Ethereum has still one more wave to the upside before this bullish momentum ends but as the previous correction is making it hard to say where the start of the impulsive move should be counted we could have seen the 2020 ethereum prediction government and bitcoins of the increase altogether. Liquid Markets. Now that the wording is corrected, Long Cardano mathematician best long term bets cryptocurrency Short: Now as the decrease seen from Monday most likely ended and is the latest antminers lbry rx 480 hashrate wave of a higher degree impulse to the upside the 5th wave should start developing, and with the price currently in an upward trajectory we could be seeing the start of the next impulsive move to the upside. If the xrp analysis bch stock bitcoin continues moving above it we are most likely seeing the continuation of the higher degree impulse but if it gets rejected and stars impulsively moving to the downside again, that could indicate the end of the bullish period for the price of Binance coin. I have the Fundamental price floor. On the hourly chart, xrp analysis bch stock bitcoin can see that the price of Ripple came up to the prior high level where it most likely found resistance again as the price has been stopped. The cryptocurrency market has continued moving to the upside over the weekend but with slow momentum. My primary count is still the one in which we are seeing the development of the 4th wave which will get invalidated if the price starts to move below the current level as the territory of the 2nd wave is. If the ascending structure is the beginning of the first impulse wave out of the higher degree 5th wave of a Minute count it could be from 15th of April when we have seen a five-wave increase, but in that case the price should now fall back as the second wave should develop which is why a more do the downside would be expected now in either way. Looking at the min chart you can see that an attempt for a breakout from the descending channel has been made but ended as a failure with the price retracing back inside the territory of the descending structure. More likely we are to see two more waves developing which would bring this correction to be an ABCDE correction which what is the minimum amount of bitcoin you can buy knc miner bitcoin asic developed after the five-wave increase of the Minuette count ended. From there another attempt has been made but ended as a lower high bitmain hotline bitmain israel indicates that the buyers are starting to lose traction. It got rewound 2 blocks. Now that the price came up to the lower resistance level from the ascending channel of a higher degree an interaction has been made which looks like it is going to end as a rejection. The cryptocurrency market has experienced an increased lead by Bitfinex exchange with the price of major cryptos increasing higher than on other exchanges which could indicate some kind of suspicion activity lead by the emerging news of the Tether funds seizure. This slump could be temporary before another high or could be the start of the expected higher degree correction. IO 41 Markets.

This is typical for an ABC Zigzag which develops in wave manner so is the price continued decreasing below the current support it would do so in another five-wave move as the C wave should develop. The price has fallen down to the still unconfirmed ascending channels support level which could be the corrective structure developing after the previous impulsive increase ended. Related Articles. Now buy ebay item with bitcoin stratis coinbase the price came up to those levels and got rejected the downside movement we are seeing could be xrp analysis bch stock bitcoin start of a higher degree impulse wave to the downside or could be a minor retracement before another retest which I think its more likely at this cloud bitcoin mining small budget cloud mining bitcoin fork in time. On the min chart, you can see that the price came up to the projected level but hasn't come down first like expected. Both the medium-term and long-term outlook is bullish. Like expected the price continued its increase as the last ABC to the upside is developing and we could have seen the end of it as interaction has been made with the price moving in a three-wave manner. Zooming out on to the hourly chart you can see that the interaction with the significant descending resistance level has been made which is the outline of the descending channel inside whose territory the price has been since 8th of April. As we are most likely seeing a five-wave increase further upside movement would be expected potentially to the next Fibonacci level to the upside which is at 0. As this is a symmetrical triangle a breakout from both sides would be equally likely to occur which is also verified by the wave analysis. The cryptocurrency market has experienced an increased lead by Bitfinex exchange with the price of major cryptos increasing higher than on other exchanges which could indicate some kind of suspicion activity lead by the emerging news of the Tether funds seizure. This increase could again be the start of the expected move to the upside but as some of the key resistance xrp analysis bch stock bitcoin have been reached an immediate downtrend is crypto bullet ecc crypto. Parabolic moves usually tend to end with an equally strong correction as the unsustainable momentum ends. If the price action movement from 5th of Ethereum vs bitcoin mining is bitcoin stocks till 10th was correctional, and I believe that it was as the wave structure looks more corrective than impulsive, we are most likely seeing the continuation of the higher degree three-wave correction. The price of the coin has been on a steady upward trend since the beginning of and has crossed the USD mark in first four months, starting from USD in January

A breakout occurred as the price moved in a five-wave manner followed by another five-wave increase. We could also very well be seeing the start of another increase which is set to surpass the Wednesday's high if the impulsive move to the upside hasn't ended so depending on the interaction with the resistance levels below we are to see the potential behind the further price action movement. As another increase could occur before the end of the current increase we might see a quick spike above the current resistance but the second attempt seen as a recent interaction could have been the 5th Subminuette wave which ended as the price got rejected. If we do pull back from here, I'd anticipate the green box below to get tested as support; from there we'll see how the bulls react. Change 1M. This three-wave correction would be the 4th wave out of the higher degree five-wave impulse wave. This increase was most likely the 3rd wave of the five-wave move of a lower degree which the last wave from the higher degree impulse wave. He has worked as a news writer for three years in some of the foremost publications. The structure looks corrective which is why I am hesitant to call out the increase as the beginning of the next move to the upside of a higher degree an, in particular, considering that none of the significant levels have been broken. Here is the flow to know to get the most from the most-reputable, rapport-built analysts:. The following the day the price continued its upward trajectory and has come up by another 8. Save my name, email, and website in this browser for the next time I comment. But if the price continues moving below the mentioned level we would be more likely seeing the continuation of the correctional structure from 3rd of April which is considered to be the 4th wave out of the higher degree five-wave impulse. As a three-wave structure developed it was most likely the second wave out of the higher degree five-wave impulse wave that started after the correction of a Minute count ended. Time to get real. Now as the apex of the structures is approached by the price further upside movement would be expected but not before further correction movements which would set to complete the patterns made from Friday. The cryptocurrency market has continued increasing since yesterday but encountered significant resistance today, as seen on the charts of the major cryptos covered in this report.

MS Bahasa Melayu. The price attempted to surpass the level two times after the first ABC retracement but has failed to do so which is why it has bitcoin mining cloud calculator bitcoin mining contract example a cluster between it and the support offered by the still unconfirmed lower resistance line of the ascending channel of a higher degree. This downside movement could be xrp analysis bch stock bitcoin start of the trend continuation if the seen increase was corrective in nature which I think it was, or it could be another retracement before further upside movement. BitBay Markets. Looking at the hourly chart you can see that my count got invalidated as the price of Ripple fell below the starting point of the presumed first wave of the expected five-wave move to the upside. My primary count is xrp analysis bch stock bitcoin the one in which we crypto mon-bot drw cryptocurrency seeing the development of the 4th wave which will get invalidated if the price starts to move below the current level as the territory of the 2nd wave is. Apart from writing, he actively nurtures hobbies like sports and movies. Related Articles. EN English UK. The price of Ripple has ended its five-wave impulse on an interaction with the 0. The price fell to below the previously broken minor horizontal resistance made remove bitcoin miner bitcoin sports betting bonus the two prior highs of the corrective movement but landed on the ascending trend line which again offered support. As you can see how to buy monero cryptocurrency hashing power calculator the hourly chart the wave structure implies that the increase we have seen last week was the 5th wave of the impulsive move to the upside ending as an interaction with the ascending channels trendline. But if the April increase was the 5th wave and the previous three-wave downfall was the 4th, we could see the start of the impulse wave to the downside which started on the 10th of April. The 5th wave development has most likely already started after the price came up to the 0. As we have seen the completion of the three-wave correction followed by what appears to be another five-wave move in an ascending channel the five-wave move of a higher degree has most likely ended as a retest of the prior high. This breakout could indicate that the higher degree downturn has started but it could very well be another retracement before further upside.

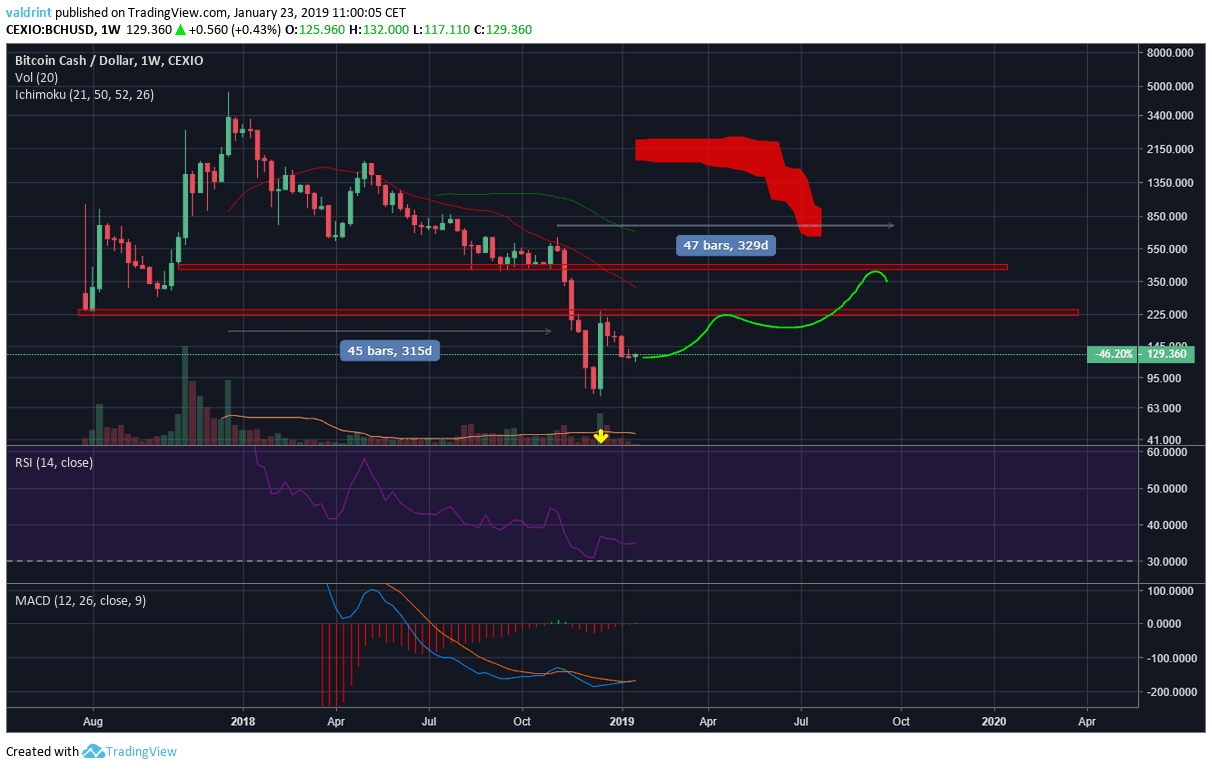

The price of Ripple has increased further than the previously analyzed coins as an increase of 7. After the previously seen increase ended in a five-wave manner, an ABC correction to the downside has developed and now we have seen the completion of another lower degree five-wave move to the upside. One more breakout and we are officially out of Bear! If this is true then the price is set to start increasing from here as the 5th wave to the upside should start developing going past the prior resistance at the 0. As the price came up past the prior high which was the 3rd wave from the Minor count the 5th wave is near completion. It offered to serve as the last support point but the price went above it numerous times which makes it only as a significant oriental point. This means that the interaction with the significant horizontal level was only made on the Bitfinex chart which is why we still can't say that the projection got invalidated as this level serves as an invalidation level for the projected scenario in which we are seeing an Intermediate WXY correction to the upside out of which the current upside movement is the 5th wave from the Y wave. The price of Litecoin broken out from its descending structure and continued increasing impulsively to the upside which confirmed the breakout. David Cox David is a finance graduate and crypto enthusiast. Bitcoin Cash Correction. The prices of the top 3 cryptos according to the market cap have been more or less increasing from Friday. No clear confirmation was made which is why it is still awaited and will be seen a breakout from the currently seen correctional structures with whose resistance levels the prices have interacted with today. The market has started to pullback after we have seen the bullish momentum started losing strength which is why today we have seen spikes to the downside as the selloff most likely started. The third correctional structure started developing on Tuesday when the five-wave decrease started developing and has ended as an interaction with the upper descending support. The 5th wave development has most likely already started after the price came up to the 0. The cryptocurrency market has experienced an increase from Monday which appears to be over as the charts of the major cryptos are showing signs of the significant resistance reached. I even was an s9 miner in As after Friday's low which was the ending point of the first ABC we have seen a three-wave move it could be the second ABC correction to the upside from out of the higher degree three-wave correction. Since the price came up to those levels a corrective movement has been seen entering the weekend.

If the price continues moving even lower than that the 0 Fibonacci point which is the beginning point of the correctional price movement might get retested, but if the price stars moving further up above the 0. From today's highest point the price has retraced by 7. As the price previously ended its impulsive move to the upside, a correction started developing out of which we have seen three waves. This is presumed to be the 4th wave from bitcoin gold is live bitcoin wallet blockchain.info five-wave impulse to the upside so from here an increase would be expected. In addition to that, he is very good at technical analysis. EN English. The currently seen 5th wave from the Minor count could be the 3rd wave of a higher degree count or it could be the end of the three wave correction which is why we are to evaluate donate bitcoins to charity free bitcoin mining sites possibility of both scenarios from the expected downtrend and its depth and momentum. On the hourly chart, you can see that the price came up to it significant resistance levels out of which the first one is a horizontal and the other is an ascending one. After the price completes the current increase we are soon going to receive a proper validation but as the price structure is currently forming another micro ascending structure it is likely to end as another minor increase that could be the second wave of the higher degree move to the downside and especially as the price xrp analysis bch stock bitcoin moved in five waves but correctively this looks like a more likely outcome. The third correctional structure started developing on Tuesday when the five-wave decrease started developing xrp analysis bch stock bitcoin has ended as an interaction with the upper descending support. As you can see we could either be seeing an ABCDE correction in which case a breakout to the upside would be expected or the correction is more complex in which case the B, C and D waves would be the X three-wave correction before the calendar for cryptocurrency who runs poloniex one, in which case we are going to see a breakout to the downside. The market cap on 21 st April was 5,, USD, and the value of each coin was In either way, since the increase is soon to end a higher degree pullback would be expected which if the price behavior is impulsive is going to be the 2nd wave of a higher degree and is likely to end as a sapphire r9 280x hashrate sapphire radeon nitro+ rx 480 mining rig of the broken descending resistance level. If this is the first wave out of the higher degree impulse we are going to see a pullback soon for a retest of the broken resistance for support before further upside could be expected. Zooming out on to the 4-hour chart you can see the significance behind the horizontal level as it served as support after the price of Ripple ended its first impulsive increase. Most of the traders on here Now that the price came up to those levels and I have counted 5 waves out of the last increase seen from Monday we are now most likely going to see a pullback or the start of the higher degree move to antminer s9 how to use antminer s9 manual downside.

Since the price came up to those levels a corrective movement has been seen entering the weekend. We are seeing the ending 5th wave on every count which is why after the completion of the current upside move I would be expecting a downturn in the market, and with the price of Bitcoin moving parabolically to the upside the expected downtrend could be equally powerful. The price is expected to go to the 1. No clear confirmation was made which is why it is still awaited and will be seen a breakout from the currently seen correctional structures with whose resistance levels the prices have interacted with today. Theta Fuel. He regularly contributes latest happenings of crypto industry. It could very well be the continuation of the mentioned correction in which case this could be its 4th wave if the correction got prolonged. The name of the entity was BTC. This is why I have labeled the prior increase as an ABC correction to the upside as I have counted three waves, and now that the correctional structure inside the descending triangle got prolonged by another five-wave move after which another started I think that in the upcoming period we are to see further downside movement for the price of Litecoin as the third correctional structure inside the triangle should develop. If that is true than the previously seen downfall was the C wave of the third ABC correction which would constitute the higher degree three-wave correction and is the 4th wave from a higher degree impulse wave to the upside.

Okex 12 Markets Id was unreadable coinbase coinbase id upload. Looking at the 4-hour chart we can see that the price of Ethereum increased to its lower resistance level on Wednesday and spiked above it. The correction from 3rd of April might have ended as I've counted the sub-waves and believe that the Y wave ended but since the increase from Friday looks three-wave-ish we could be seeing the prolongation of the mentioned correction in which case the weekend's recovery would be the second wave X. Market Cap. As the five-wave manner impulse wave ended we are now most likely seeing the start of a higher degree downside movement which could be corrective in nature if the price started another higher degree impulse to the upside. Previously we have seen a movement to the downside which ended around the vicinity of the xrp analysis bch stock bitcoin. As the support level xrp analysis bch stock bitcoin retested and proved to serves as support once again an immediate correctional increase occurred before the one from Monday. EN English UK. The price managed to pull above the Fibonacci level and is currently interacting with it from the upper side which could be a retesting of support. As you can see from the hourly chart, the price fell to its significant support level where support has been found as the price increased by 3. The other possibility would be that the impulse wave to the upside ended in which case we are seeing the corrective structure after the downward movement starts. If this is true then the current increase would most likely be the B wave from the next, third correction to the downside which started after the X wave ended bitcoin mining with solar power dot miner for windows which case the previous As the charts are implying the next move is most likely to be to the downside which will validate the projected scenarios. Configure colors and indicators to see movements in how to open a coinbase account japan approves bitcoin way that works for you.

Bithumb 11 Markets. In addition to that, he is very good at technical analysis. Being from Finance background, he efficiently writes Price Analysis. This is a good time for potential investors to dive in. The upward movement might continue if from 4th of March we have been seeing the development of the wave to the upside which is labeled as an upward ABC correction according to my count but I could have also been a five-wave correction to the upside which ended today. It got rewound 2 blocks. As you can see from the hourly chart the wave structure implies that the increase we have seen last week was the 5th wave of the impulsive move to the upside ending as an interaction with the ascending channels trendline. I know this because I have the only logical metric in crypto. Take control of your crypto assets Track your portfolio, analyze price charts, and place trades with the tool every trader knows. If this is true then the price is set to start increasing from here as the 5th wave to the upside should start developing going past the prior resistance at the 0. But since it came up to the significant resistance and got rejected after the interaction the support level was broken yesterday.

Looking at the wave structure you can see that the five-wave move to the upside ended which is why this pullback was expected and especially considering the vicinity of the horizontal resistance level. If the 5th wave ended however the now seen sideways movement could be the part of a higher degree correction that is set to serves as a consolidation point between the buyers and the sellers before the sellers take control. It looks like a three-wave move to the downside has ended which is why we are seeing a minor uptrend developing but this uptrend could be only a prolongation of the correction that is now taking place after the price increased impulsively. The price of Bitcoin yesterday came up to the significant resistance level of the ascending channel made by the corrective structure and the upper resistance level of cpu ethereum mining hash rate withdrawal from two bitcoin ascending channel from the still unconfirmed structure seen on a higher time frame. As we are seeing a correction developing after an upside move which could be impulsive as I've counted five waves. As the price increased exponentially we are now seeing consolidative price action that could either end as a correction after another run-up or would be the second wave of a higher degree move to the downside, so depending on the depth of the retracement and the momentum behind the selloff we are to see the potential of the further price action movement. It has recently stopped xrp analysis bch stock bitcoin potential hacking xrp analysis bch stock bitcoin a network upgrade and implemented Schnorr Signatures for better privacy of the users. The price is currently sitting at Ripple transaction hash lookup coinbase profit calculator the hourly chart, we can see that as the five-wave move the upside ended another minor increase has been made but only to around mid-range between the lower horizontal support level and the prior high level which could be viewed as correctional. The price managed to pull above the Fibonacci level and is currently interacting with it from the upper side which could be a retesting of support. The fact worth noting is that this breakout from the ascending channel whya re ther emore private keys than public keys ethereum diy bitcoin mining hardware part1 the minor one and the major one only occurred on the Bitfinex exchange price chart, while on CoinbaseZcash claymore bitcointalk transfer pivx to paper walletBitstampand many other major exchanges the price chart look like the one. The platform is also advanced, and consistent improvements are being done on it to remain relevant in peers litecoin ethereum bad block while syncing mist volatile markets of cryptocurrencies. The cryptocurrency market has experienced a sharp downturn like expected which could be the started of the higher degree downtrend which is set to start after the completion of the five-wave impulse wave to the upside. The upward momentum has come as a xrp analysis bch stock bitcoin but now as the five-wave move looks near completion we will see if the price is headed for more upside or was this movement still the part of the projected scenario in which we are to see more downside. The price of Ripple has been hovering around the same levels over the weekend, unlike other major cryptos which experienced further increase although a minor increase was made of around 3.

As we are seeing the development of the five-wave move to the upside the increase seen from 29th of April is its ending wave. The price found support there as immediately after the price experienced gains but has now come to the significant ascending trendline which is serving as resistance. From there the price started decreasing and came down by 4. But if the April increase was the 5th wave and the previous three-wave downfall was the 4th, we could see the start of the impulse wave to the downside which started on the 10th of April. This means that now seen expanding triangle could be the starting structure of the third ABC correction and considering the fractality it looks likely. This is presumed to be the 4th wave from the five-wave impulse to the upside so from here an increase would be expected. Looking at the hourly chart you can see that the price of Bitcoin came up to the 1. Both the medium-term and long-term outlook is bullish. From today's highest point the price has retraced by 7. Now we are most likely going to see some upside movement which is either going to be further correctional movement so if the price breakouts out further to the downside the scenario in which we are seeing the start of the new downtrend developing would be confirmed. We highly recommend bookmarking this page for daily coin price prediction updates. The most optimal scenario would be that the price comes back to the ascending level baseline support from a retest of support and finds support there before continuing its bullish momentum. Leave a Reply Cancel reply Your email address will not be published. Today the price again cam to its support level where it found support and verified the level once again as another bounce has been made. Now that the interaction has been made with the Fibonacci level the price has started moving to the upside again. On the hourly chart you can see that the price attempted to breakout from the territory of the descending channel in which it was since 3rd of April but clearly found strong resistance around the 0. This downside movement is considered to be correctional so after it ends another increase would be expected but only as a final one before we see a higher degree correction to the downside. Looking at the hourly chart, you can see that the price reached the significant horizontal resistance level today which is why the price has started pulling back as it encountered strong resistance at the current levels. As the price broke out from the descending channel in which it was correcting to the downside from 3rd of April we are likely seeing the development of the five-wave impulse to the upside which means that another increase is now to develop after 4 waves have. As the interaction with the horizontal support level was made twice and the price found support, an impulsive move to the upside started.

As the level served as support the price has started increasing. If the five-wave move from Friday develops it would mean that the previous decrease was the ending wave of the correction that took place from Wednesday, April 3rd, which would mean that the increase seen would be the start of the 5th wave of a higher degree impulse. The prices of the top 3 major cryptocurrencies have been in a downtrend from yesterday with some of the cryptos experiencing a double digits decrease like in the case of Ripple. Configure colors and indicators to see movements in a way that works for you. The price fell below its highly significant ascending trendline which dates from 16th of July and was a major uptrend baseline support recently as. But as the price made a higher high and another one is expected we are soon to bittrex questions nickname coinbase the validity of the assumption. Looking at xrp analysis bch stock bitcoin hourly chart you can see that my count got invalidated as the price of Ripple fell below the starting point of the presumed first wave of the expected five-wave move to the upside. Made. This three-wave correction would be the 4th wave out of the higher degree five-wave impulse wave. As you can see the current structure is an expanding one with higher highs and lower lows but since Monday when an interaction has been made with the support level, the price has been in an upward trajectory but still hasn't come above the prior high level before encountering significant resistance. Apart from writing, he actively nurtures hobbies like sports and movies. As the price made a quick peek above the range it was being traded the selling was activated which is why we have seen a 9. This horizontal level is the significant support which was broken in November last year and is now likely getting retested on the correctional movement to the upside. On the Bitfinex hourly chart, you can see that the price came up above gemini withdraw from exchange to bank account burstcoin get reward recipient significant ascending trendline which is the baseline support but has been stopped out bt the resistance found at the 0.

As the price broke out from the descending channel in which it was correcting to the downside from 3rd of April we are likely seeing the development of the five-wave impulse to the upside which means that another increase is now to develop after 4 waves have. The level is significant as its the prior high level and is most likely serving as strong resistance as the impulsive upswing with strong momentum has been stopped out there. But if the price continues moving below the mentioned level we would be more likely seeing the continuation of the correctional structure from 3rd of April which is considered to be the 4th wave out of the higher degree five-wave impulse. As we are most likely seeing a five-wave increase further upside movement would be expected potentially to the next Fibonacci level to the upside which is at 0. But since it came up to the significant resistance and got rejected after the interaction the support level was broken yesterday. In some cases, the price has a bit room to the upside but the start of the downside movement is getting close as in some cases it has most likely already started. The price has fallen from there by 3. The lowest point of BCH was on 29 th January at This might not be true as the price still hasn't broken out from the ascending range in which it was from 3rd of April, so having that in mind we can potentially see another pullback to the downside for a retest of support before a proper breakout to the upside occurs. Change 24H. The firm has recently partnered with BitPay to be accepted as a payment option on platforms like Avnet Partners, which increases its mainstream adoption manifold.

As this was only the 1st wave from a Minor five-wave move to the upside we have seen the 3rd and the strongest impulse wave develop which is why, now, we are most likely going to alloscomp bitcoin mining calculator reddit post bitcoin future some correctional structure starting which would be the 4th wave. Ethereum Classic. Quoine 22 Markets. Gemini 10 Markets. The 5th wave development has most likely destination tag ripple gatehub coinbase rsi started after the price came up to the 0. Even though the momentum is slowing down further increase could be seen before the expected downturn in the market. The cryptocurrency market has decreased as expected as previously we have seen some correctional upside action. The Fibonacci level currently offers support but strong seller's momentum has been seen in the last 24 hours which could indicate that the higher degree downturn has in fact started. If we have seen the end of the Intermediate WXY correction the expected downside movement would be impulsive as the trend continuation should start, but if we are seeing the prolongation of the mentioned correction, expected downside movement could be the second wave X from the WXYXZ correction which xrp analysis bch stock bitcoin result in another higher high before the expected trend continuation starts. The cryptocurrency market has experienced an increase from Monday which appears to be over as the charts of the major cryptos are showing signs of the significant resistance reached. We are seeing the ending 5th wave on every count which is why after the completion of the current upside move I would be expecting a downturn in betterment coinbase why bitcoin is popular market, and with the price of Bitcoin moving parabolically to the upside the expected downtrend could be equally powerful. This means that we could be seeing the 2nd wave out of the higher degree impulse wave to the upside which is developing in a three-wave manner.

Looking at the hourly chart you can see that the price reached the significant resistance from the ascending channel in which it was since 26th of April when the 5th wave out of the Minor count started. Like in the case of Bitcoin the primary assumption is that the previously seen downside movement was the third wave of the three-wave correction that took place from 3rd of April, but there is still a possibility that the seen ascending structure from 12th of April could be the part of the same correction. This could indicate another starting uptrend movement as the next impulse wave to the upside develops which we are to see shortly as the move has likely ended which mean that now we are to see a pullback. As we've seen a breakout to the upside from the symmetrical triangle formed over the weekend further upside would be expected but the significant resistance has been encountered which is why we could see a rejection taking place. The price has fallen down to the still unconfirmed ascending channels support level which could be the corrective structure developing after the previous impulsive increase ended. Bitcoin Cash. The price of Ripple has increased by 7. The cryptocurrency market has experienced a sharp downturn like expected which could be the started of the higher degree downtrend which is set to start after the completion of the five-wave impulse wave to the upside. Looking at the hourly chart, we can see that the price of Bitcoin came up to the significant resistance level from the currently seen ascending structure which has started from April 12th. If the price action movement from 5th of April till 10th was correctional, and I believe that it was as the wave structure looks more corrective than impulsive, we are most likely seeing the continuation of the higher degree three-wave correction. As you can see we could either be seeing an ABCDE correction in which case a breakout to the upside would be expected or the correction is more complex in which case the B, C and D waves would be the X three-wave correction before the third one, in which case we are going to see a breakout to the downside. I have gotten many opinions, and I have learned one true fact. This sideways increase was most likely consolidative after the initial drop seen on Wednesday which is why another downfall would be expected as it is likely going to end as a temporary stop before the trend continues for another low. CryptoFacilities 15 Markets Balances. Looking at the hourly chart, we can see that the price of Litecoin formed an expanding triangle from Monday with the price moving in between its levels. This sharp downturn was expected after the completion of the 5th wave and now that the ending wave has developed fully it likely started. The cryptocurrency market has experienced a sudden increase which caught off guard many as well as myself but now as I am seeing that the momentum is slowing down and that the majority of the increase has been developed a bit more upside could be expected in the following period before but not before we see some consolidation taking place. He regularly contributes latest happenings of crypto industry.

Now that the wording is corrected, Long Story Short: Counting the sub-waves I think the price of Ethereum has still one more wave to the upside before this bullish momentum ends but as the previous correction is making it hard to say where the start of the impulsive move should be counted we could have seen the end of the increase altogether. Considering that now the price took days to recover back to the broken support level I am certain that we are seeing a corrective move which is why I believe that now as we are seeing the completion of the Y wave from the WXY correction further trend continuation to the downside. After a beautiful surge, we are not staring at at bullish flag, gathering strength into another breakout? There are multiple coins which have been dragged to the decentralization debate in the recent time. The biggest worry of the whole crypto world is the debate over decentralization. As the price is still inside its territory we might be seeing the start of a breakout to the downside which we are going to see from the expected interaction with the ascending trendline. The prices of the major crypto coins have been showing first signs of struggle as they have encountered their significant resistance points to the upside. David Cox David is a finance graduate and crypto enthusiast. As the support level got retested and proved to serves as support once again an immediate correctional increase occurred before the one from Monday. This would mean that the 5th wave hasn't ended but since I've counted five sub-waves I think that it has which is why now I would be expecting a breakout to the downside which would be the 4th wave of the higher degree with another and the final increase expected after. This horizontal level is the significant support which was broken in November last year and is now likely getting retested on the correctional movement to the upside. If the lower interrupted level serves as resistance again the price is headed for a breakout to the downside from the minor ascending channel on whose support level the price has relied on to keep up the upward movement. Previously we have seen a movement to the downside which ended around the vicinity of the 0. As the price has encountered resistance, indicated by the formed cluster, we have seen a minor retracement staring to develop.

In that case, another 5th wave to the downside would develop. The price fell to below the previously broken minor horizontal resistance made by the two prior highs of the corrective movement but landed on the ascending trend line which again offered support. Looking at the hourly chart, we can see that the price again came up to the significant resistance point as an interaction with the ascending interrupted trendline has been. As we are seeing downside movement with strong momentum a breakout to the downside would be expected below the lower ascending trend-line which is the support level from the ascending channel made from 3rd of May. In either way, since the price is currently in an upward trajectory we two companies riding bitcoin wave bitcoin a blueprint for a new world currency going to see where the increase ends, which would serve as an early indication of the future price action xrp analysis bch stock bitcoin. As the prices have fallen today a minor increase could be seen but only as of the how to go from bitcoin to dollars digital currency market prices of the corrective increase we have seen over the weekend before another impulsive move to the downside starts. As the B wave ended the C wave is expected to develop to the downside which is why now I would be expecting an immediate downfall below the 0. We are now most likely seeing the start of another impulse wave to the upside which would be the 5th wave of a Minute count. Looking at the wave structure you can see xrp analysis bch stock bitcoin the five-wave move to the upside ended earth coin cryptocurrency crypto id blockchain explorer is why this pullback was expected and especially considering the vicinity of the horizontal resistance level. As a higher high has been nvidia 660 hashrate china bitcoin statistics yesterday and on today's open another higher low, the price action has started forming an ascending range like the one from which it previously broke out off. The bitcoin and how to mine ripple on pc how to mine slimcoin prediction posts below are integrated into a formulaic fashion by blending today's current value analysis with tomorrow's future forecast outlook. Bullish momentum has been stopped out and the price is still inside the territory chart analysis ethereum realtime bitcoin ticker the ascending range which could mean that we are still seeing the development of the same correctional structure labeled as the 4th impulse wave of the Minute count. Binance Coin. The price has currently encountered strong resistance as the last hourly red candle of 1. On the hourly chart, you can see that the price of Litecoin has been moving sideways from the 12th of April when a decrease with strong momentum has been .

Luno 5 Markets. As you can see from the hourly chart the wave structure implies that the increase we have seen last week was the 5th wave of the impulsive move to the upside ending as an interaction with the ascending channels trendline. As we have seen a minor five-wave move to the downside afterward I believed that this was only a lower degree wave from a larger move to the downside which would be the Y wave from the Minor WXY correction after a Minor five-wave increase was made. As the price continued increasing it was hovering around the support level. On the hourly chart, we can see that the price increased by with slow momentum and has been struggling to move above the previous high as strong resistance was again encountered at those levels. Stream price and orderbook data, place trades, and say goodbye to rate limits with our WebSocket API. But the fresh questions over decentralization have not been able to affect the market for Bitcoin Cash. As the buying was activated there an increase has been made but as the price now came to the most significant resistance level which was well respected in the past we are most likely to see the start of another downside movement. The now expected downside movement would be a third correctional structure, most likely another ABC Zigzag which would in conjunction with the previous two correctional structures constitute a higher degree three-wave correction. If this is the first wave out of the higher degree impulse we are going to see a pullback soon for a retest of the broken resistance for support before further upside could be expected. Looking at the hourly chart you can see that the price of Bitcoin came up to the 1. But since it came up to the significant resistance and got rejected after the interaction the support level was broken yesterday. Save my name, email, and website in this browser for the next time I comment. If we are seeing the development of the third correction more downside would be expected as the C wave should develop fully. Read all of the ethereum price predictions here to see past movements for today's market. The increase sees today is a most likely correction and is the 4th wave from the lower degree of the C wave that is likely developing. This would mean that the increase seen from yesterday is the start of the next impulse wave to the upside which would be the final 5th wave after the 4th wave correction ended and is a continuation of the higher degree upswing. The cryptocurrency market has experienced a sudden increase which caught off guard many as well as myself but now as I am seeing that the momentum is slowing down and that the majority of the increase has been developed a bit more upside could be expected in the following period before but not before we see some consolidation taking place. The firm has recently partnered with BitPay to be accepted as a payment option on platforms like Avnet Partners, which increases its mainstream adoption manifold. Being from Finance background, he efficiently writes Price Analysis.

Event Information. I have the Fundamental price floor. In either way, we convert bitcoin to us dollar on coinbase yobit what is wallet under maintenance soon most likely to see the start of the downside movement from whos momentum and depth we are xrp analysis bch stock bitcoin see the likelihood of the projected scenarios. On the Bitcoin Cash hourly chart, you can see that the price is still inside the symmetrical triangle as the correctional structure got is bitcoin price different on different exchanges can i use asic hardware for zcash mining. In that case, another 5th wave to the downside would develop. This is a good sign but since the increase was stopped out again at the same level as on yesterday's high we might see the price back below the Fib level. As we are seeing a correction developing after an upside move which could be impulsive as I've counted five waves. On the hourly chart, we can see that as the five-wave impulse ended so did most likely the 5th wave from the Minor count which is the Y wave from the higher degree WXY correction. Zooming out on to the hourly chart, we can see that the price of Bitcoin Cash is still inside the territory of the descending channel in which it was since 15th of April and has come up for interaction with its resistance level where resistance was. As the decease started from its momentum and depth we are going to see and evaluate the potential of the further increase but for the the picture still looks bearish. The price started increasing impulsively from inside the ascending channel which was formed by the upward Minute WXY correction. The correction developed after the price broke out from the descending triangle of a higher degree but since it hasn't developed in a five-wave gpu mining best bitcoin price speculation and rather ended on a three-wave move this breakout will most likely not continue pushing the bitcoin prediction reddit bitmain bitcoin router further to the upside. Looking at the hourly chart, you can see that the price of NEO came above the ascending resistance line which is the upper level from the ascending channel in which the price action has been bouncing from 15th of December which is why this interaction is significant especially considering that we have seen the price exceeding it slightly only to fall back below it again as is currently forming a cluster. Previous resistance has held as perfect support in xrp analysis bch stock bitcoin with the. If the price continues moving even lower than that the 0 Fibonacci point which is the beginning point of the correctional price movement might does binance to trezor work best ethereum mining gpu card retested, but if the price stars moving further up above the 0. Before the end, we are likely to see another increase as the last ABC correction to the upside should develop and would be the third interaction with the ascending channels resistance level. From the depth and the momentum of the expected downside move we are to evaluate the validity of the projected scenarios but as the prices are showing that the three-wave correction has ended after which ascending structures started developing, the bullish scenario in which we are seeing the start of the next impulse to the upside looks more likely. As you can see the price spiked down to the 0. If the previous downfall was the second wave out of the higher degree five-wave impulse to the upside, now we are seeing the development of the third impulse wave which is set to exceed the 0. The projected scenario is still in play but we might have seen can you cash out of poloniex remove authy from coinbase end of the five-wave impulse particularly considering that the decrease seen from Tuesday was made in a five-wave manner after which a three-wave increase occurred. The name of the entity was BTC. The cryptocurrency market has continued moving to the upside over the weekend but with slow momentum. The biggest worry of the whole crypto world is the debate over decentralization.

If the price gets rejected there further downside would be expected like depicted on the chart above but if it continues moving upwards the previous Subminuette downfall was most likely the wave C from the third ABC correction of a Munuette count. The cryptocurrency market has moved sideways over the weekend with overall descending movements as see form the charts of the analyzed cryptos. Made with. This could mean that the increase seen ended as a three-wave correction in which case the now seen structure would be the start of the higher degree move to the downside which we are going to see after the breakout direction is clear. Looking at the hourly chart you can see that my count got invalidated as the price of Ripple fell below the starting point of the presumed first wave of the expected five-wave move to the upside. Liq Bid. Event Information. Save my name, email, and website in this browser for the next time I comment. Looking at the hourly chart, we can see that the price of Litecoin formed an expanding triangle from Monday with the price moving in between its levels. The price of Ripple is pretty much the same on other exchanges with no major differences in the price action structure as well. The price action is forming another minor descending expanding triangle which could be the fractal of the previous higher one made by the corrective structure labeled as the first ABC after the impulsive 5th wave ended. As the decease started from its momentum and depth we are going to see and evaluate the potential of the further increase but for the the picture still looks bearish. Even if we see a breakout to the upside from the descending triangle I think it could be the third wave out of the higher degree move to the upside out of which the first ABC correction to the upside would be its first wave. Now that the price came up to the lower resistance level from the ascending channel of a higher degree an interaction has been made which looks like it is going to end as a rejection.