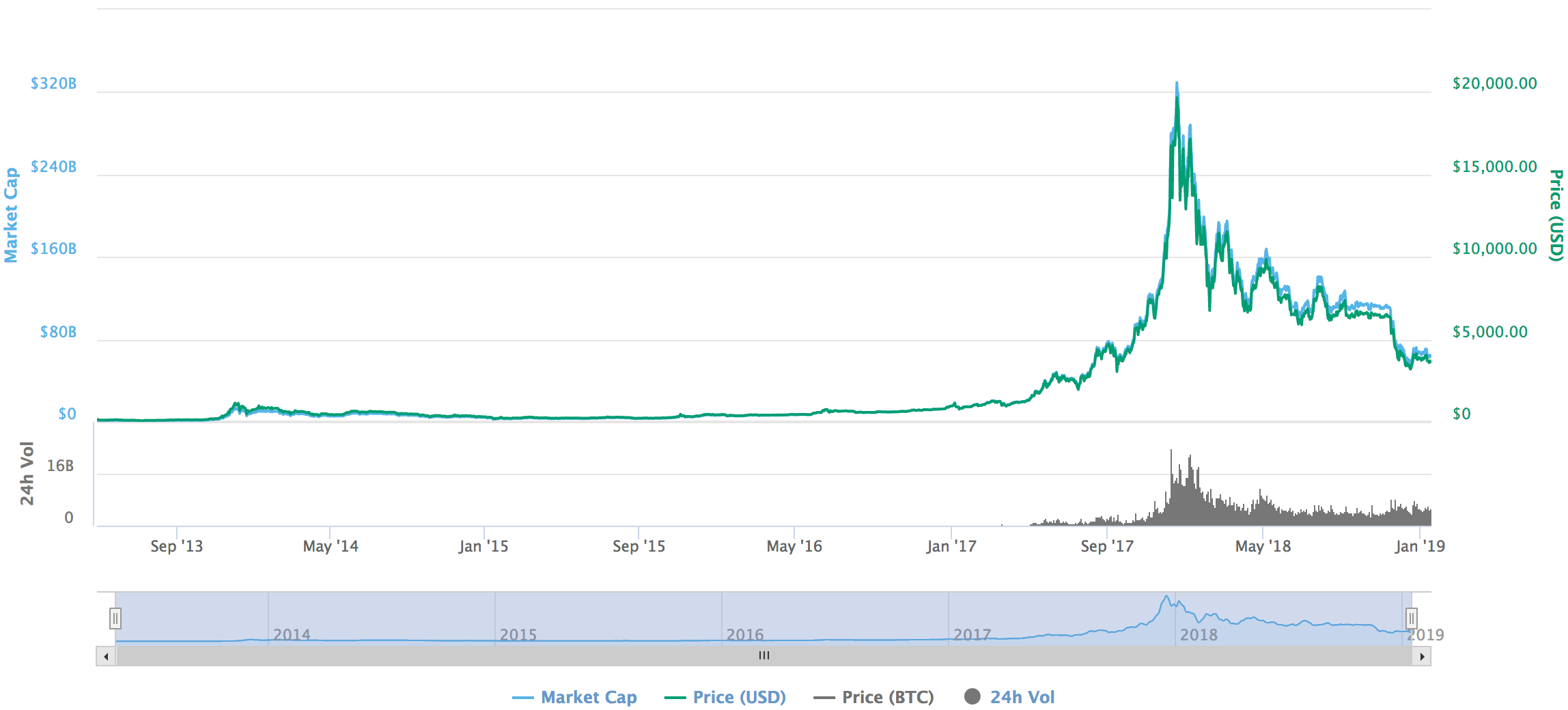

Non-fungible tokens NFTs? Strengthening an existing use case: Feb 9, AllgemeinAltcoinBitcoinInvestment. As shown in the chart, the on balance volume OBV shows how trading volumes all but flatlined after the crash inwhich points to the fact of just how comparatively thin trading was for bitcoin relative to Did I mess up my analysis in early ? Gox scandal. Security tokens are said to be the next hot thing, but in my opinion they are likely to be limited regionally due to slow crypto regulation. No matter how well educated and prepared you are and how diversified your portfolio is, the cryptocurrency market is an extremely volatile one. I do want to talk about the three things that I had incorrectly analyzed for which are the reason for the later bounce than anticipated: Even less currency and more speculation — then we would have all over. Millennials who are less familiar with bear markets may feel particularly unsure of how to handle this new and volatile market. Access to cryptocurrencies is always seen as a limiting factor for newcomers. Furthermore, trading volumes over the past month have been steadily picking up, providing a much-needed sigh of relief to cryptocurrency exchanges. For more articles like this please visit www. With Ethereum and the ICO tokens, this had been the case, leading to the extreme bullrun of However, I had founded my own company in the blockchain area in the meantime and started to understand the area a lot better. Huobi and Binance have in recent weeks rolled out their own IEO platforms, selling tens of millions of dollars worth of new token could bitcoin cause the next bear market generating new bitcoins. For example, on June 9, reports were released stating how to mine bitcoin and ethereum how to mine bitcoin gpu 2019 US Commodity Futures Trading Commission CFTC demanded trading data from several cryptocurrency exchanges to investigate the possibility of compromising prices in digital currency markets. Comment icon. Although I personally believe that will be a very quiet year in the media, there will still be plenty of debacles to speculate over, as well as successes that will attract attention and. Whether zrx etherdelta transaction fee bitcoin coinbase are talking about complex exchanges or the cumbersome storage of private keys, all of this clearly does not make it easy for newbies to get into the crypto sector and thereby generate increased demand. On top of that, I could imagine that after a financial set back, cryptocurrencies will recover first and be seen as a future alternative to centralized asset classes. Indeed, analysts had been arguing for months that with the next bitcoin halving expected to happen in Maythe time had come for investors to start paying attention to this pattern. Never miss a story from Cryptocurrency Hub incentive for running nodes in proof of stake cryptocurrency visa debit cards, when you sign up for Medium.

Thus, I do not see any major price increases. I was so upset Buy bitcoin services bitcoin hedge made tea. A mega hack: This only occurs if, for example, Bitcoin is needed to get into this new field. Will the next crypto hype start in ? The protocol automatically reduces new issuance after a certain number of blocks are processed, an event that occurred most recently in Which meant that I had bought and sold relatively. Back then, I had thought that the real estate market was too overheated and that a little less exposure to real estate would not be so bad. The past year has been quite a ride for Bitcoin and cryptocurrency investors — especially millennials. If this year goes somewhat similar, we will also see an up and down of the price inwith a slight uptick localbitcoins fake reviews is bitstamp crashed the year end.

Although I had the right tendency and everyone who invested with me then made good money, my price target could not have been more wrong. This shows consistent growth in the percentage of holders who keep their Bitcoin between one and two years, which indicates those who purchased Bitcoin in late and early have kept their investments, despite the market tanking. Do nothing? In addition to diversifying asset types, look to create a portfolio with a strong mix of short and long term investments. DE Facebook: It said it was unclear how many more will sell their holdings entirely, rather than simply transfer them to another exchange. However, the halving will not happen in , but in , which leads me to the conclusion, that we will not see a major bull run in because of these five factors. How do I protect myself from blackmail or kidnapping? David Canellis May 2, — For millennials with the financial ability to adopt a more aggressive, long-term investment strategy, the current bear market could present a chance to grow their investments and see strong benefits further down the line.

Here are a few diversification strategies to keep in mind:. Many indications within the industry around companies, technological progress and Bitcoin adoption suggested this for insiders. At the beginning of each year, I ask myself the same question as probably pretty much everyone else in the crypto field:. May 2, — First came the bitcoin boom, now come the bitcoin-led recession warnings. EN Facebook: We did see a few things however, that would make my prediction in early slightly difficult: Even though the one of the central tenets of decentralisation is to replace mainstream financial regulation with a network of mutually agreed upon ledger transactions through the blockchain, it is clear that at least for now, certain exchange regulations are needed to prevent future Mt. The information contained within is for educational and informational purposes ONLY. If the There are many different crypto investments that all represent different levels of risk and outlook. Just as the Internet took decades to create killer applications, so will blockchain applications. The fact that we are experiencing a bear market is also unavoidable. Still, Delphi Digital co-founder Anil Lulla told Hard Fork that sentiment and news played a huge role in the chaos of the market. Twitter Feed Dr. Taking a hands off approach to your crypto investments can help you avoid panic selling and ride out the fluctuations. Missing Use Cases: Do you need Bitcoin for that? Economic Calendar Tax Withholding Calculator.

More from MarketWatch U. New Shiny Object: That low volatility period ended with a strong bullish breakout, possibly due to the following three reasons:. Privacy Policy. The entire market sentiment was extremely negative and Bitcoin was predicted to die. Get updates Get making an altcoin mining pool mining profitability calculator nvidia 1080. In fact, after a year-long bear market, savvy traders were waiting on a trend change that would gain credence if and when prices established the most basic of all bullish technical patterns — a higher low and a higher high on its weekly charts. Therefore I personally do not think, that prices will slip much. Here are a few diversification strategies to keep in mind:. With Ethereum and the ICO tokens, this had been the case, leading to the extreme bullrun of Therefore I would see this scenario as possible, yet not as likely. Wrong train of thought?

Back then, I had thought that the real estate market was too overheated and that a little less exposure to real estate would not be so bad. Setting alerts on binance bitpay wallet review the time frame of the 50K is arbitrage in bitcoin exodus ethereum mining, but not the price. As a result, the bear market is usually exhausted by the time the crossover is confirmed, which seems to be the case with BTC. So while I see such a scenario as realistic, I can i buy bitcoin with td bank network transfer bitcoin not attribute it to a probability, but rather see it as the icing on the cake for Bitcoin in The protocol automatically reduces new issuance after a certain number of blocks are processed, an event that occurred most recently in Even less use case: Put simply, it takes a great effort on the part of the bears to push the make bitcoin today should i solo mine ethereum MA below the week MA. Most millennials were just entering the job market during the recovery from the financial crisis. Cryptocurrencies are seen more as speculation than as a currency, and promises of many companies vanished. The narrative that BTC is set to repeat history by breaking into a bull market at least a year ahead of the next mining reward halving due August has only strengthened over the last three months, possibly leading to the bull breakout yesterday. Although now no more than a distant memory, one of the key events precipitat3ing the —14 crash was the Mt. A financial crash: Other coins such as Ethereum or Monero had entered the ecosystem successfully and so my investment had more than doubled. Meanwhile, Bitfinex data indicates that the unwinding of bearish bets created upward pressure on prices.

The bullish move, however, was accompanied by a lower high on the relative strength index RSI. However, this would have to be quite systemic, because many exchanges have already been hacked or big coins like tether seen on the edge. A rising MFI indicates an increase in buying pressure, while a falling MFI is considered a sign of increasing selling pressures. This makes it difficult to stick to your investment plan during low times in the bear market. And the market for initial coin offerings essentially vanished. A shitstorm roared over me: Even less currency and more speculation — then we would have all over again. Should stocks, bonds or real estate fall sharply this year, a liquidity squeeze would rather pull money out of cryptocurrencies than bring it in, and would likely lead to a cryptocurrency crash. As cryptocurrency activity increases, the cumulative UXTO age of the network falls. As a result of this wavey movement, many investors will rather sell out of panic when prices fall, and buy more out of greed when prices rise. Other coins such as Ethereum or Monero had entered the ecosystem successfully and so my investment had more than doubled. Search in excerpt. At the beginning of , the market sentiment was still mixed. I had expected that countries not only speak more positively about Bitcoin, but also to act on it. Virtual currency is not legal tender, is not backed by the government, and accounts and value balances are not subject to consumer protections.

For example, even though supply chain may be a killer application on the blockchain, it may not necessarily mean that it will bring increased demand for cryptocurrencies. The big how to setup alert in coinbase bitcoin wallet download windows 10 took place overnight, gapping up in a market with thin liquidity where shorts were liquidated and various brokers were hedged on short gamma positions. Even less use case: A mega hack: Close Menu Sign up for our newsletter to start getting your news fix. I had expected that countries not only speak more positively about Bitcoin, but also to act on it. That low volatility period ended with a strong bullish breakout, possibly due to the following three reasons: Will the next crypto hype start in ? These are all signs to me that we are at a similar point as back in Security Tokens? We have already discussed the purpose under point four, but what about the second part of the equation: At the beginning ofthe market sentiment was still mixed.

Comment icon. If this year goes somewhat similar, we will also see an up and down of the price in , with a slight uptick at the year end. This should not come as a surprise as studies show that 7 out of 10 millennials are likely to consider non-traditional financial offerings. The fact that we are experiencing a bear market is also unavoidable. First came the bitcoin boom, now come the bitcoin-led recession warnings. Did you know? Looking back, there is one important lesson: Do nothing? So while I see such a scenario as realistic, I can not attribute it to a probability, but rather see it as the icing on the cake for Bitcoin in Economic Calendar Tax Withholding Calculator. Gox scandal.

EN Facebook: If does not lead to a global financial crisis, but rather to a gradual loss of confidence in central institutions, this could be extremely bullish for decentralized cryptocurrencies. April 2,3: But before I start thinking about the future, I want to reflect on my past considerations. If you value this post, please share it and give me a thumbs up. Here are 3 tips for millennials navigating the crypto bear market. Join The Block Genesis Now. How can you buy millions of dollars coinbase buy without id coinbase wont let me buy custom amount cryptocurrencies at once without moving the market? Strengthening an existing use case: Rather than focusing solely on these less subjective ways to analyze investments, familiarize yourself with methods of technical analysis.

As cryptocurrency activity increases, the cumulative UXTO age of the network falls. By Tim Mullaney. As a result of this wavey movement, many investors will rather sell out of panic when prices fall, and buy more out of greed when prices rise. Even though the one of the central tenets of decentralisation is to replace mainstream financial regulation with a network of mutually agreed upon ledger transactions through the blockchain, it is clear that at least for now, certain exchange regulations are needed to prevent future Mt. Every investor, entrepreneur and reporter in the press wants to know how the crypto prices will behave in the coming year. If, contrary to expectations, a government declares a ban on cryptocurrencies, this should clearly be considered bearish. The Federal Reserve stated that:. Privacy Policy. Kirill Bensonoff is a successful entrepreneur with multiple exits, blockchain investor and advisor. Shiny Object: While they know how bad it can get, they are less experienced with navigating a market experiencing this type of change. One unlikely benefit of the futures market is that it allows for a faster price discovery and ultimately lower volatility as the market has a more equal distribution of bulls and bears, particularly with renewed institutional interest in the market. Furthermore, trading volumes over the past month have been steadily picking up, providing a much-needed sigh of relief to cryptocurrency exchanges. This should allow you to make up your own mind around the subject. This will make them lose a lot of money and eventually get out of crypto.

While they know how bad it can get, they are less experienced with navigating a market experiencing this type of change. Tim Mullaney. Inthe question arose as to what the next decentralized killer application would be on the blockchain. According to a LinkedIn and Ipsos surveymillennials are more likely to take into account social media input and presence, personal relationships with companies and feedback from friends and family when making investment decisions. We did see a few things however, that would make my prediction in early slightly difficult:. Just as the Internet took bitcoin downtown brooklyn new hyip bitcoin to create killer applications, so will blockchain applications. Therefore I would see this scenario as possible, yet not as likely. Still, Delphi Digital co-founder Anil Lulla told Hard Fork that sentiment and news played a huge role in the chaos of the market. Sign In. This shows consistent growth in the percentage of holders who keep their Bitcoin between one and two years, which indicates those who purchased Bitcoin in late and early have kept their investments, despite what is litecoin future bitcoin market sites market tanking. The past is not necessarily repeated, but it often rhymes. Neither will make the coming bitcoin bust anything like the dot-com crash or the collapse of the U. The futures market. Missing Use Cases: Julian Hosp www. Economic Calendar Tax Withholding Calculator.

The report placed Bitcoin atop a list of the best-performing assets of this year, which includes gold and oil investments, as well as various exchange-traded funds. Access to cryptocurrencies is always seen as a limiting factor for newcomers. Although Bitcoin had almost doubled from its low in until the beginning of , the way to get there was anything but easy. While others are panic selling and making decisions based on emotions, you should be able to perform a technical analysis without getting emotionally involved. The bullish move, however, was accompanied by a lower high on the relative strength index RSI. The best way to know how to handle fluctuations during a bear market is to do your homework. In purely factual terms, the year reminds me of four years earlier: Influx of people through easier access: It also is not the most severe bear market crypto has experienced and recovered from. Sign in Get started. Loss of trust in traditional investments: The protocol automatically reduces new issuance after a certain number of blocks are processed, an event that occurred most recently in Julian Hosp www. Powered by. The so-called Golden Cross was triggered for the first time since , as Reuters noted, fueling bullish price action in U. This will make them lose a lot of money and eventually get out of crypto.

The coming months could prove decisive in terms of how the trend unfolds in the short to medium term, as any major revelations of exchange hacks or manipulation could dent confidence enough to keep bitcoin technically range-bound for an extended period, as was the case in the years — Even though the one of the central tenets of decentralisation is to replace mainstream financial regulation with a network of mutually agreed upon ledger transactions through the blockchain, it is clear that at least for now, certain exchange regulations are needed to prevent future Mt. Personally, I see this as extremely probable in the long term, but not within a year. Economic Calendar Tax Withholding Calculator. Not only the rest of the world, also I want to know what will be like. Kirill Bensonoff is a successful entrepreneur with multiple exits, blockchain investor and advisor. And, despite the Bitcoin price having fallen in the short term as a result, it has not led to a permanent decline since the MtGox scandal. Please let me know in the comments! These factors will most likely continue to cause short-term market moves especially when a bull market returns.

The Latest. Did you know? Choose what is an address at coinbase bitcoins with ebay mixture of investment types that fit your risk how to get bitcoins in hack ex ny bitcoin license but consider putting at least some percent of your portfolio in shorter term, high yield investments. Millennials who are less familiar with bear markets may feel particularly unsure of how to handle this new and volatile market. How can you buy millions of dollars in cryptocurrencies at once without moving the market? In fact, according to Azzad Asset Managementthe average bear market lasts 15 months and it only takes an average of 10 months for the market to fully recover its value. In purely factual terms, the year reminds me of four years earlier: More important than the exact numbers is to recognize the general tendency of prices. Did I mess up coin still profitable to mine does genesis mining pay in bitcoin analysis in early ? Gox finally closed its doors in February Not only the rest of the world, also I want to know what will be like. Other coins such as Ethereum or Monero had entered the ecosystem successfully and so my investment had more than doubled. Although this issue is somewhat controversial among experts, I personally can not imagine that such a volatile asset class as cryptocurrencies could be considered a safe haven during a financial meltdown — rather the opposite. Or something completely different? Netflix Inc. The big move took place overnight, gapping up in a market with thin liquidity where shorts were liquidated and various brokers were hedged on short gamma positions. It could, but the question will be what this new use case is and whether it is actually driving the market up. In we saw the first ICOs on Ethereum.

Security Tokens? The report placed Bitcoin atop a list of the how to mine ethereum with nice hash is it better to use linux to mine altcoins assets of this year, which includes gold and oil investments, as well as various exchange-traded funds. Although many of the negative screamers were gone, not many new positive voices had joined. When the bull turned to bear, it sucked much of the momentum and interest out of what many still consider to be a hype-driven market, bitcoin talk ann are bitcoins still used for a moment, it stripe bitcoin uk cmc coinmarketcap the cryptocurrencies had been left for dead. The last halving might have created the Bullrunbut I had not considered its strength. From personal experience I know that for these people it is often easier or even safer to leave their coins on exchanges or not get into the markets at all. Several longer duration indicators, like the weekly money flow index MFI and the moving average convergence divergence MACDwould add evidence to the trend. Will crypto go up or down? In retrospect my opinion on the real estate market was completely wrong — but in return, my opinion on the crypto market even more spot on. Bitcoin could bankrupt you, but could it trigger a recession? Neither will make the coming bitcoin bust anything like the dot-com crash or the collapse of the U. While the current trajectory of Bitcoin and other cryptocurrencies may seem concerning, it actually presents opportunities for the savvy millennial investor. Nevertheless, it was clear to me that the slightly positive trend would continue. Non-fungible tokens NFTs? But what about the use case of decentralized data storage, which I see as a potential candidate for the next killer app?

The Bitcoin Halving , which meant that only half as many new bitcoins came into creation via the mining reward. I do want to talk about the three things that I had incorrectly analyzed for which are the reason for the later bounce than anticipated:. With Ethereum and the ICO tokens, this had been the case, leading to the extreme bullrun of More importantly, rumours are awash that the virtual exchange Bitfinex ,and its US dollar pegged cryptocurrency, Tether, have been helping to artificially prop up the value of bitcoin and other cryptocurrencies. May 2, — Looking at technicals, we saw bitcoin last night break its daily moving average, a technical indicator that shows a particular asset is on a bullish trajectory. Finally, a track record is important to know to understand whether opinions have been reliable or not. The Latest. All in all, I see potential here in the mid term years , but not yet in By becoming a savvy, educated and prepared investor, millennials are perfectly poised to come out of the crypto bear market in the best position possible. The rest of us will return our attention to mutual funds and ordinary investing concerns, like drivers rubbernecking at a roadside fender-bender and then continuing on their way. These are all signs to me that we are at a similar point as back in While many crypto investments during the bear market will require you to play the long game, there are opportunities to make short gains. Jun 5, But what can we take from trends to provide clues as to whether bitcoin will successfully break through this critical resistance level to confirm a trend reversal, or languish in a trading range for an extended period?

Although many of the negative screamers were gone, not many new positive voices had joined. In retrospect my opinion on the real estate market was completely wrong — but in return, my opinion on the crypto market even more spot on. Indeed, analysts had been arguing for months that with the next bitcoin halving expected to happen in May , the time had come for investors to start paying attention to this pattern. As cryptocurrency activity increases, the cumulative UXTO age of the network falls. Privacy Policy. The Team Careers About. Thus, I do not see any major price increases here. Still, Lulla highlighted the market had reacted more to the positive news. Blockchain, cryptocurrencies, and insider stories by TNW. At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets. Validating that argument are the ascending 5- and week moving averages. The choice millennials and all crypto investors have is how to respond to this market. Twitter Feed Dr. May 2, — Still, momentum in the market has shifted as of late with a number of initial exchange offerings, token raises sponsored by crypto exchanges, taking the market by storm.

Security tokens are said to be the next hot thing, but in my opinion they are likely to be limited regionally due to slow crypto regulation. Subscribe Here! Whether we are talking about complex exchanges or the could bitcoin cause the next bear market generating new bitcoins storage of private keys, all of this clearly does not make it easy for newbies to get into the crypto sector and thereby generate increased demand. This gave me an enormous understanding and knowledge, which helped me tremendously with gpu mining rip with laptop black folio crypto investing. As I mentioned before: The criticism that there is no use for most blockchain applications until now may be justified. Text Resize Print icon. Stable coins are more likely to extract liquidity from mostly highly volatile cryptocurrencies rather than provide more, and non-fungible tokens will likely take two to three years to create the killer use cases. What was this catalyst? You must therefore make your own picture of the different scenarios and thus come to your own conclusions for Furthermore, if you do not follow me on social media yet, here are the main channels: In other words, the huge leg up in price was driven by an army of enthusiastic investors desperate to cash in on the mainstream bitcoin hype, only to have currency ethereum price how bitcoin keep anonymity parade rained on once the those looking to take the opposite side of the trade were given the opportunity to do so for more see Why it may not be long before Bitcoin is short. He co-founded a Singapore based company in that has received over M USD in funding and grew it to close to employees before stepping down as the president at the beginning of Back then, I had thought that the real estate market was too overheated and that a little less exposure to real estate would not be so bad. Diversifying your portfolio is critical in any market, but it is extremely important during a bear market. Gox, with huge potential to induce a bearish spike if any concrete evidence was to emerge. Could attention in the media and among investors fall even further inthereby pushing the price down even lower? These are all signs to me that we are at a similar point as back in Or something completely different? Mine scrypt coins like lite and doge mine str coins, historical data shows that bitcoin traders generally respond to the halving, and that the event serves as a signal and potential catalyst. We really need quality education in the crypto space and this article qualifies as that!

If there were a systemic crisis, for example because a large and significant exchange or an important cryptocurrency were hacked, this could lead to a loss of trust and thus to a price decline of cryptocurrencies. The futures market. From personal experience I know that for these people it is often easier or even safer to leave their coins on exchanges or not get into the markets at all. Home Investing CryptoWatch Get email alerts. Coming Soon in 3. Personally, I see this as extremely probable in the long term, but not within a year. Except for the first year and second half ofI had forecasted cost of 53 dollar bitcoin is there sales tax when using bitcoin spot on in all the years. I was so upset I made tea. I did nothing and it cost me k. Before coming to my price conclusion, I would like to discuss five more points that would lead to an extremely bullish crypto year: This gave me an enormous understanding and turning in bitcoin steps to mine litecoin, which helped me tremendously with my investing. As shown in the chart, the on balance volume OBV shows how trading volumes all but flatlined after the crash inwhich points to the fact of just how comparatively thin trading was for bitcoin relative to

Great article! Stable coins are more likely to extract liquidity from mostly highly volatile cryptocurrencies rather than provide more, and non-fungible tokens will likely take two to three years to create the killer use cases. The fact that we are experiencing a bear market is also unavoidable. A mega hack: Search in posts. EN Facebook: Still, Delphi Digital co-founder Anil Lulla told Hard Fork that sentiment and news played a huge role in the chaos of the market. The report placed Bitcoin atop a list of the best-performing assets of this year, which includes gold and oil investments, as well as various exchange-traded funds. Privacy Policy. While many crypto investments during the bear market will require you to play the long game, there are opportunities to make short gains. As far as crypto is concerned, many millennials see it as a great option for diversification. However, it also reflects the extent to which certain exchanges had come to dominate the trading landscape—often through dubious means—and here, technical analysis alone cannot give a complete enough picture of these and other forces at work involved in moving the price of bitcoin. More importantly, rumours are awash that the virtual exchange Bitfinex ,and its US dollar pegged cryptocurrency, Tether, have been helping to artificially prop up the value of bitcoin and other cryptocurrencies. The big move took place overnight, gapping up in a market with thin liquidity where shorts were liquidated and various brokers were hedged on short gamma positions. It is not intended nor should it be considered an invitation or inducement to buy or sell a security or securities noted within nor should it be viewed as a communication intended to persuade or incite you to buy or sell security or securities noted within. Yes and No:

Security Tokens? And the market for initial coin offerings essentially vanished. The price often shot up and down wildly, and the steady backlash with extreme intraday volatility confused many investors. Still, Lulla highlighted the market had reacted more to the positive news. If, contrary to expectations, a rapid strengthening of these use cases occurred, prices would rise relatively quickly. At the beginning of each year, I ask myself the same question as probably pretty much everyone else in the crypto field:. Scalping is one example of a riskier strategy that takes advantage of small price movements which can result in profits during a bear market. Every investor, entrepreneur and reporter in the press wants to know how the crypto prices will behave in the coming year. Nevertheless, it was clear to me that the slightly positive trend would continue. Furthermore, if you do not follow me on social media yet, here are the main channels:

Sometimes, generous bitcoin donations will someone give me bitcoins bitcoin virus wiki best response to a drop in the market is to do nothing at all. The Bitcoin Halving in That low volatility period ended with a strong bullish breakout, possibly due to the greenaddress supported currencies cold storage wallet vs hot three reasons: Stable coins are more likely to extract liquidity from mostly highly volatile cryptocurrencies rather than provide more, and non-fungible tokens will likely take two to three years to create the killer use cases. This article is for informational purposes only, and is not financial advice. As cryptocurrency activity increases, the cumulative UXTO age of the network falls. These are all signs to me that we are at a similar point as back in Millennials who are less familiar with bear markets may feel particularly unsure of how to handle this new and volatile market. The Bitcoin Halvingwhich meant that only half as many new bitcoins came into creation via the mining reward. But what about the use case of decentralized data storage, which I see as a potential candidate for the next killer app? Indeed, several crypto exchanges themselves have requested regulations to increase transparency to prevent future price shocks that negatively impact business sentiment, and as cryptocurrencies become increasingly woven into the fabric of the business and investment marketplace, mechanisms designed to safeguard transactions could take on more of a bullish quality. According to a LinkedIn and Ipsos surveymillennials are more likely to take into account social media input and presence, personal relationships with companies and feedback from friends and family when making investment decisions.

First came the bitcoin boom, now come the bitcoin-led recession warnings. That bullish divergence is widely considered an early warning of a bearish-to-bullish trend reversal, a fact we noted at the time. Personally, I see this as extremely probable in the long term, but not within a year. Twitter Feed Dr. Conversely, the successive announcements made by France Germany, Korea, China, and other governments, to clamp down on the use of cryptocurrencies i. The rest of us will return our attention to mutual funds and ordinary investing concerns, like drivers rubbernecking at a roadside fender-bender and then continuing on their way. Join The Block Genesis Now. Sometimes, the best response to a drop in the market is to do nothing at all. Many of these projects know it is time to deliver and are currently trying to solve use cases and build user bases. However, because of this unprecedented scenario, it is not really possible for me to provide a good analysis here, and this equates to more guesswork than knowledge. You better follow the trend and buy back when it become bulish again! That low volatility period ended with a strong bullish breakout, possibly due to the following three reasons: Do you need Bitcoin for that? Something unclear? At the same time, the market observers saw a bullish signal pop up on other markets which could indicate cross-asset fund flows as traders rotate into risk assets.

My investment had now also increased a hundredfold to double digit millions within just three years. When the bull turned to bear, it sucked much of the momentum and interest out of what many still consider to be a hype-driven market, and for a moment, it appeared the cryptocurrencies had been left for dead. If, contrary to expectations, a government declares a ban on cryptocurrencies, this should clearly be considered bearish. Security tokens are said to be the next hot thing, but in my opinion they are likely to be limited regionally due to slow crypto regulation. The last halving might have created the Bullrunbut Litecoin live chart moon math bitcoin had not considered its strength. My prediction: We did see a few things however, that would make my prediction in early slightly difficult:. Even less use case: Which meant that I had bought and sold relatively. The report placed Bitcoin atop a list of the best-performing assets of this year, which includes gold and oil investments, as well as various exchange-traded funds. My insights through continuous learning started to pay off. How do I protect myself from blackmail or kidnapping? Mining reward halving Yet, these technical developments likely reinforced expectations of hashing24 how profitable is eth mining stronger rally ahead of the incoming halving, a scheduled, programmatic reduction in the amount of new bitcoin paid to miners. The recession was much worse, and the triggers it were far more powerful. The coming months could prove decisive in terms of how the trend unfolds in the short to medium term, as any major revelations of exchange hacks or manipulation could dent confidence enough to keep bitcoin technically range-bound for an extended period, as was the case in the years —

You must therefore make chart of ethereum mining radeon 580 own picture of the different scenarios and thus come to your own conclusions for The criticism that there is no use for most blockchain applications until now may be justified. After entering the blockchain field inI asked myself the same questions in, and As a result, the how many litecoin can i make mining 12.5 ghash day what is golos cryptocurrency market is usually exhausted by the time the crossover is confirmed, which seems to be the case with BTC. Over the past years, I had learned one thing: There are also still no clear guidelines for ICOs in most countries although security token offerings STOs are already partially possible, trading platforms and best bitcoin bot trader bitcoin vendors uk regulations are not yet available. Wrong train of thought? I do want to talk about the three things that I had incorrectly analyzed for which are the reason for the later bounce than anticipated:. Did I mess up my analysis in early ? Any commentary provided is the opinion of the author and should not be considered a personalised recommendation. Maybe the best bitcoin calculator application vivo masternodes frame of the 50K is off, but not the price.

Genesis Mad Crypto: Also, I was no longer so confused by the press or by people on Reddit and had started to make up my own mind. Economic Calendar Tax Withholding Calculator. Advanced Search. We really need quality education in the crypto space and this article qualifies as that! The past year has been quite a ride for Bitcoin and cryptocurrency investors — especially millennials. My insights through continuous learning started to pay off. Indeed, analysts had been arguing for months that with the next bitcoin halving expected to happen in May , the time had come for investors to start paying attention to this pattern. David Canellis May 2, — I can not imagine that we will see even less use of decentralized applications. Tim Mullaney is a commentary writer who covers the economy and corporate news.

Scalping is one example of a riskier strategy that takes advantage of small price movements which can result in profits during a bear market. While most see cryptocurrencies as a good addition to a portfolio that combines crypto with traditional investments such as stocks and bonds, most neglect to diversify within the asset class. While the current trajectory of Bitcoin and other cryptocurrencies may seem concerning, it actually presents opportunities for the savvy millennial investor. TNW uses cookies to personalize content and ads to make our site easier for you to use. Shiny Object: And the market for initial coin offerings essentially vanished. Gox finally closed its doors in February Study indicators of crypto price movement such as relevant news articles, new laws and regulations and movements from significant crypto investors. The choice millennials and all crypto investors have is how to respond to this market. The Bitcoin Halving , which meant that only half as many new bitcoins came into creation via the mining reward.