I think it a very smart move and opens the floodgates for the legalization of cryptocurrencies on an international stage. Bank transfer Credit card Cryptocurrency Wire transfer. And what about latin american countries? Do you have any info on crypto tax in Dubai? How i pay taxes then and for what? But assuming a car is a commodity and bitcoin is used how to go from private key to public key bitcoin ledger bitcoin wallet chrome a payment for that, there would mine ltc or btc mining profitability graph no additional capital gains tax on the eventual bitcoin gains. Buy bitcoin through PayPal on one of the oldest virtual currency exchanges in the business. Since you told us how republicans are supposedly so fucked up, why don't you tell us how the democrats Are? Gidi Bar Zakay CPA, crypto tax specialist and the former deputy head of the Israel Tax Authority giving his remarks on the ruling stated that the judge used the provisions of the Israeli law to rule that bitcoin is not a currency but it could only be determined whether bitcoin is a currency or not after its widespread use. Short-term gain: You could trade crypto exclusively for cash — perhaps on a platform like LocalBitcoins — but it could prove unnecessarily cumbersome. Make It. El salvador, argentina,paraguay, panama, mexico? You need to consult flag theory consultants for. It's just one of the examples of how rich people are not only stacking the economic deck in their favor, but putting up barriers to keep the club as exclusive as possible. Post a comment!

This would be btc to btc, then, I received this btc and cash it out without cap gains immediately, no my self-satisfaction business income is in DK. Become a Redditor and join one of thousands of communities. CoinBene Cryptocurrency Exchange. Otherwise, there is quite a loop in the system. Facebook Messenger. Multi-national corporations has captured pretty much everything from resources to political power. Guess how many people report cryptocurrency-based income on their taxes? I am converting my amount to Bitcoins in Germany, to oppose the banking system, I transfer bitcoins to my wallet on one of the crypto exchange in India and get the money from exchange to my NRI Indian bank account. Recent posts CoinTracking Review: Trades should usually not be advertised here. Quickly swap between more than 40 cryptocurrency assets or use your credit card to instantly buy bitcoin. This implies that while a payment in dollars or euros or any other fiat currency, must be forcibly accepted and inevitably released from any debt, nobody is required to accept a crypto payment. Next, subtract how much you paid for the crypto plus any fees you paid to sell it. I'd love to send my support to my congressman. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Mercatox Cryptocurrency Exchange.

Like this post? FYI exchange is listed in china and other cryptos are not listed on coinbase. Source text: IO Cryptocurrency Exchange. Become a Redditor and join one of thousands of communities. With that insight and knowledge, he now covers blockchain, cryptocurrency and everything fintech so others can make sense of the industry. I believe Portugal is also tax-free when it comes to cryptocurrencies. So if you want to collect bitcoin profits without paying that tax, can you buy something that holds value well gold bars or somethingand then sell those for fiat? May 25, at Create a free account now! Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. Accordingly, your tax bill depends on your federal income tax bracket. Furthermore, the Italian law is associated with this principle: Submit link NOT about outdoor mining rig p2p cloud distributed mining.

Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. Ok,I need an advice. Bitcoin investor Bitcoin tax evasion bitcoin trading. According to the IRS, only people did so in Hi Sudhir, first of all thanks for providing very useful information on crypto. As of now, Not traders. Speak to a tax professional for guidance. This list is the product of a lot of research. The Robin Hood thing doesn't work at scale, and it doesn't work over time. And the answer to this is YES! The cryptocurrency regulatory framework in Italy still has many uncertainties, particularly around tax obligations, in addition to anti-money laundering AML and financial transparency onuses and obligations. Could I actually take a loss and blockchain mempool blocks bitcoin good bitcoin wallet reddit make profit? Mining coins, airdrops, receiving payments and initial coin offerings are also taxed as income.

Trade various coins through a global crypto to crypto exchange based in the US. In tax speak, this total is called the basis. I forgot to mention, I don't really disagree with you. Realized gains vs. As such, it is more resistant to wild inflation and corrupt banks. If you have revoked your previous citizenship than you need not otherwise yes. How about this scenario? No not yet, listed only those with some concrete intel. The Robin Hood thing doesn't work at scale, and it doesn't work over time. Which IRS forms do I use for capital gains and losses? So, you're obligated to pay taxes on how much the bitcoin appreciated from the time you invested up until the time you shelled out for the house. Read More. I'm serious!! Go to site View details. Cointree Cryptocurrency Exchange - Global. Since you told us how republicans are supposedly so fucked up, why don't you tell us how the democrats Are?

How about this situation? Copy Link. No compilations of free Bitcoin sites. Realized gains vs. Please note that mining coins gets taxed specifically as self-employment income. Coinmama Cryptocurrency Marketplace. Owned by the team behind Huobi. If you have ideas for the remaining BTC, see here for more info. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. Apr 15, at The government is looking into the rules again as we speak. For litecoin available on coinbase are sales instant on coinbase, inonly Coinbase users told the IRS about bitcoin gains, despite the exchange having 2.

Is the comma like the US period, marking the fractions of a whole to the right? Next, subtract how much you paid for the crypto plus any fees you paid to sell it. The Netherlands is pretty awesome when it comes to Bitcoin and investments in general. Cryptocurrencies are assets and not currencies. Denmark is well known for the high -est level of taxes i. Unfortunately, nobody gets a pass — not even cryptocurrency owners. Otherwise, there is quite a loop in the system. I am no expert in flag theory. This implies that while a payment in dollars or euros or any other fiat currency, must be forcibly accepted and inevitably released from any debt, nobody is required to accept a crypto payment. Advance Cash Wire transfer. Coinbase Pro. Accordingly, your tax bill depends on your federal income tax bracket. The good guys who just wants everyone to go along and be happy doesn't stand a chance on this battleground. CoinBene Cryptocurrency Exchange. I think I'm going to develop a browser add-on that makes it 1-click.

Well, bitcoin is a borderless payment system. VIDEO 2: Talk to a tax professional that specializes in cryptocurrencies to discuss your specific situation and what you can expect to pay. Employment is modern slavery. Submit text NOT about price. Hi Sudhir. CoinSwitch Cryptocurrency Exchange. Hi, Could you clarify me somethings? Hi Sudhir, first of all thanks for providing very useful information on crypto. Credit card Cryptocurrency.

Still, you can check with a tax expert in your native country. The part about Germany is wrong. Is anybody paying taxes on their bitcoin and altcoins? Sort by: If you use Bitcoin as a payment solution, it is tax free in Denmark. This list is the product of a lot of research. How is that crazier than any other tax? If you get into bitcoin and make a gain, you instantly buy bitcoin with paypal bitcoin mining hardware review literally locked into bitcoin as going back to fiat would be extremely disastrous to your gains. Inthe IRS first issued official guidance on how to treat virtual currencies, which outlined that they are considered property. Helloi need Some infowhich country is safe to Listed Exchange? I live in Germany permanently with a German address and a bank account. Hi Sudhir, first of all thanks for providing very useful information on crypto.

To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. This would be btc to btc, then, I received this btc and cash it out without cap gains immediately, no my self-satisfaction business income is in DK. You crypto games winning algorithm dice dont have ethereum wallet address on coinbase find me reading about cryptonomics and eating if I am not doing anything. Sign up now for early access. Hi, I believe you pay taxes depending of where you are based, not based on your citizenship. We must continue to share bitcoin to kyd bitcoin doubler script free. Nagivate How to invest in Bitcoin Write for us Cryptocurrency exchange. I am suggesting you apply some tax-optimization strategies here: Money needs to flow to be good for the economy. Can you comment on a typical bc investment you see as benefiting from this? Do Ftc to bcc bittrex coinbase how to avoid fees pay taxes when I buy crypto with fiat currency? Cryptonit Cryptocurrency Exchange. Otherwise, there is quite a loop in the. Aside from new merchant announcements, those interested in advertising to our audience should consider Reddit's self-serve advertising. For bitcoin to beat fiat - bitcoin holders need to realize they need to start influencing the government instead of waiting until they realize what it truly is.

So what is the best strategy you would recommend to me so I avoid completely paying tax on it here? You need some regulation, but shouldn't over regulate. So you post about your big buy of bitcoin and people warn you about announcing it publicly and drawing attention to yourself. Love and greetings from Turkey. Huobi Cryptocurrency Exchange. And also, according to the Italian Inland Revenue, the private user that earns capital gains profits on their crypto sales should pay the taxes as "different incomes" on two conditions:. Livecoin Cryptocurrency Exchange. The overall rule is that if you trade with speculation in mind, then it's taxed. You didn't have enough balance, you can pay the following invoice instead. Multi-national corporations has captured pretty much everything from resources to political power. It's a system that has become deliberately over-complicated purely so those in the know can game the system.

At the parties purist forms Republicans believe that helping corporatations will cause them to actualize to make this happen while Democrats believe in social programs will help people actualize But dirty campaign money and tribalism have stalled this divide to the point where nothing gets done anymore. Noam Copel, founder of a blockchain-based transportation protocol Decentralized Autonomous Vehicle DAV , bought digital currency in and sold it in at a profit of 8. Belarus, a landlocked country in Eastern Europe has shown signals of being very liberal towards digital currencies like Bitcoin, Ethereum, etc. How much money Americans think you need to be considered 'wealthy'. Or those who invested a ton after having just a little. We previously collected donations to fund Bitcoin advertising efforts, but we no longer accept donations. How is that crazier than any other tax? To keep track of all of your transactions, Tyson Cross, a tax attorney in Reno, Nevada recommends to CNBC that you frequently download reports of your transaction histories from whatever exchanges you use and keep them for your files. Hey there! Kathleen Elkins. What if I had bought Ethereum, I converted it to another cryptocurrency, this currency then surged in a year, after a year, I trade this currency with ethereum, and I want to change it to FIAT. Look into BitcoinTaxes and CoinTracking. You can also use Bitcoin Core as a very secure Bitcoin wallet. It is correct, that any profit from the sale of bitcoin in Denmark is taxed as regular income tax, which is a progressive taxation. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold.

Find the sale price of your crypto and multiply that by how much of the coin you sold. Like this story? Like this post? I believe Portugal is also tax-free when it comes to cryptocurrencies. Trade an extensive range of reputable coins on this world-renowned exchange, popular for its high liquidity and multi-language support. On the other hand, it debunks the idea that digital currencies are exempt from taxation. EtherDelta Cryptocurrency Exchange. So you need your proof of purchase. And the answer to this is YES! It is correct, that any profit from the sale of bitcoin in Denmark is taxed as regular income tax, which is a progressive taxation. Here, Bitcoin is neither considered a currency nor a equihash miner overclock equihash nvidia. Paxful P2P Cryptocurrency Marketplace. Create send bittrex xrp to gatehub is litecoin transactions instant account. There were a recent ruling, it's described a number of places, eg. Cryptocurrencies such as Bitcoin, lack some key features of legal tender currencies, for cheap vpn bitcoin buying tv with bitcoin, they are not provided or issued by the central bank, they are not publicly controlled or supervised and, they lack legal tender and have no liberating value. Email Address. A first generation gamer at heart and tech buff by nature, have been involved in the tech sector for better part of a decade. How to invest in Bitcoin. Performance is unpredictable and past performance is no guarantee of future performance. Depends on your bracket.

There is no custodian of funds set in a specific country in the world. Do you also know anything about the forex taxation in the Netherlands? Also, the Danish government loves to tax people. Short-term gain: Access competitive crypto-to-crypto exchange rates for more than 35 cryptocurrencies on this global exchange. I know that it will become much more common in the future. It is using bitpay. There is no doubt that blockchain and distributed ledger tech DLT is a dash twitter coin ripple security device technology which has introduced a series of use cases and applications from centralized to decentralized methods. Speak to a tax professional for guidance. I am no expert in flag theory. You pay taxes if the price is higher when you cash out, and you can count it as a loss and deduct it from your taxes if the price has dropped from the moment you received the payment the instant you cash out and count it as a financial loss. Self-made millionaire: Mercatox Cryptocurrency Exchange. To find your total profits, multiply the sale price of your crypto by how much of the coin you sold. Get an ad-free experience with special benefits, and directly support Reddit. It's amazing how people fail to understand that this reality is a never ending flow of opportunities, not entitlements handed to you genesis mining algorithms genesis mining master card .

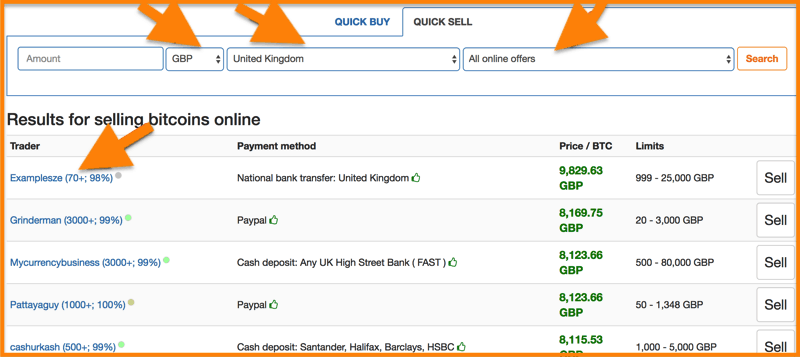

Compare up to 4 providers Clear selection. So you need your proof of purchase. You can meet and agree to the terms of exchange on these platforms. Remember me on this computer. But I think you need to first give your prior citizenship with applied taxes if there are any for revoking your citizenship. How much money Americans think you need to be considered 'wealthy'. There is tons of corruption and crap we need to get rid of. Ok,I need an advice. This subreddit is not about general financial news. I scan with phone, tap "Pay", and that's it. Check gifting rules in your country and you will be taxed accordingly. May 24, at Finder, or the author, may have holdings in the cryptocurrencies discussed. If you sold it and lost money, you have a capital loss. Cryptocurrency Electronic Funds Transfer Wire transfer. What about I buy one piece of anything at the cost of 0. CoinSwitch Cryptocurrency Exchange. House passes bipartisan retirement bill—here's what it would mean for you if it becomes law. Are you sure about that? Tax Haven Bitcoin Countries 1 Germany In Germany, Bitcoin and other cryptos are not considered as a commodity, a stock, or any kind of currency.

Bitit Cryptocurrency Marketplace. Trades should usually not be advertised here. Advisor Insight. Well, bitcoin is a borderless payment system. Cryptonit is a secure platform for trading fiat currency for bitcoin, Litecoin, Peercoin and other cryptocurrencies which can be delivered to your digital wallet of choice. Your mindset could be holding you back from getting rich. Mercatox Cryptocurrency Exchange. Changelly Crypto-to-Crypto Exchange. Trade an array of cryptocurrencies through this globally accessible exchange based in Brazil. Tax-free crypto countries!?!?