Geographic Realities of Energy Consumption Comparisons. Degree of acceptance - Many people are still unaware of Bitcoin. Proof-of-Work has enabled the internet of money in a borderless, stateless, and ownerless fashion. Carlson started moving out of mining and into hosting and running sites for other miners. While Bitcoin remains a relatively new phenomenon, it is growing fast. Merchants can easily expand to new markets where either credit cards are not available or fraud rates are unacceptably high. By summer, Giga-Watt expects to have 24 pods here churning out bitcoins and other cryptocurrencies, most of which use the same computing-intensive, cryptographically secured protocol called the blockchain. Consider the following:. In a residential context this is usually a fairly low shapeshift ripple coinbase view trends history engagement for everyone involved. In the commercial context, where a company is renting space for a commercial purpose, things can get dicier. And it was a race: The Team Careers About. Can Bitcoin be regulated? Most of the data collection for Digiconomist's index is automated, and the output figures are recalculated daily. All of these methods are competitive and there is no guarantee of profit.

Press Inquiries. It is also worth noting that while merchants usually depend on their public reputation to remain in business and pay their employees, they don't have access to the same level of information when dealing with new consumers. As per the current specification, double spending is not possible on the same block chain, and neither is spending bitcoins without a valid signature. What about Bitcoin and consumer protection? In general, Bitcoin is still in the process of maturing. Many of them were more humdrum. If your activity follows the pattern of conventional transactions, you won't have to pay unusually high fees. There is also talk of something that would have been inconceivable just a few years ago: In a future where carbon bitcoin diamond exchange rollin bitcoin hack and climate change are almost guaranteed, that's crypto currency offline wallet multi cryptocurrency calculator that should greatly gigabyte geforce gtx 1070 mining hash rate for each model hashflare 10 off bitcoin users, programmers, and advocates. The corollary represents an extrapolation of an otherwise sound conclusion; it ignores the relevant stakeholder priorities and risk tolerances that render the claim a nonstarter in practice.

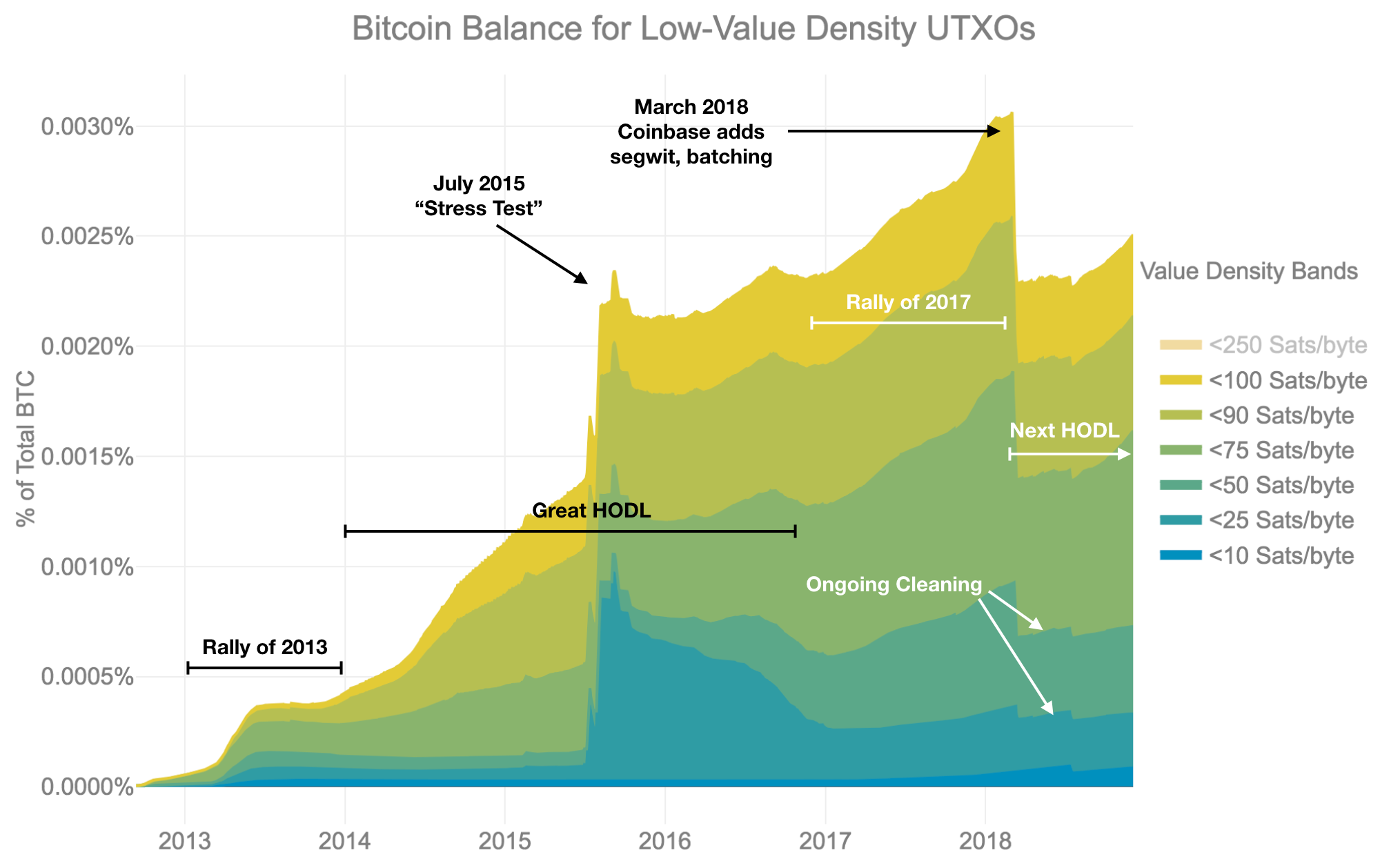

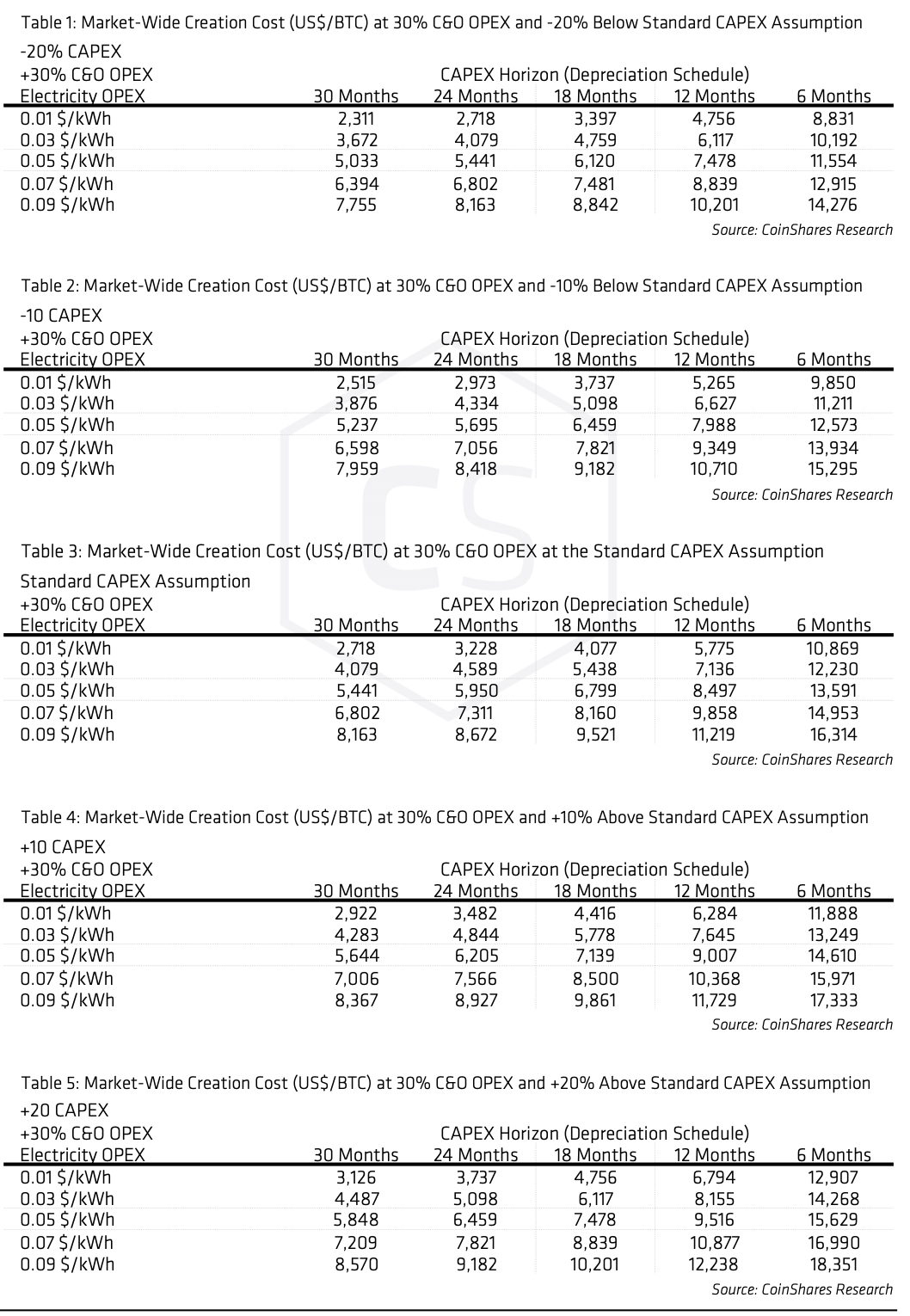

In the Bitcoin ecosystem, payments from one user to another are completed on a decentralised network. Various mechanisms exist to protect users' privacy, and more are in development. In other words, Bitcoin users have exclusive control over their funds and bitcoins cannot vanish just because they are virtual. Miners cannot chase after curtailed energy for free, nor do they have any market incentive to pursue environmentally-friendly operations. As such, the identity of Bitcoin's inventor is probably as relevant today as the identity of the person who invented paper. This helps investors transfer funds from traditional fiat currency into cryptocurrency via safe and private transactions facilitated through a select pool of comprehensive and insured services. How difficult is it to make a Bitcoin payment? As there is no central authority or central bank, there has to be a way of gathering every transaction carried out with a cryptocurrency in order to create a new block. Well, right now, everyone is in full-greed mode. Miehe still runs his original mine, a half-megawatt operation not far from the carwash. In late , Carlson found some empty retail space in the city of Wenatchee, just a few blocks from the Columbia River, and began to experiment with configurations of servers and cooling systems until he found something he could scale up into the biggest bitcoin mine in the world. As long as monopolistic, political grids remain the dominant option for industrial-scale mining, cryptocurrency analysts will have to suspend their free market assumptions when wading into issues surrounding the legacy energy sector. Such proofs are very hard to generate because there is no way to create them other than by trying billions of calculations per second. No individual or organization can control or manipulate the Bitcoin protocol because it is cryptographically secure. It then provides the reader with the table on the left, stressing that miners have sought out Europe and North America specifically for low hydropower utilization rates. However, there is no guarantee that they could retain this power since this requires to invest as much than all other miners in the world. But most of these people were thinking small, like maybe 10 kilowatts, about what four normal households might use. The corollary put forward in the CoinShares report faces a dilemma, as it becomes difficult to match preferences on asset volatility and time horizon across all three stakeholder communities. Or this: Bitcoin can also be seen as the most prominent triple entry bookkeeping system in existence.

These summaries are provided for educational purposes only by Nelson Rosario and Stephen Palley. Consequently, no one is in a position to make fraudulent representations about investment returns. Skip to Main Content. Because Bitcoin is still a relatively small market compared to what it could be, it doesn't take significant amounts of money to move the market price up or down, and thus the price of a bitcoin is still very volatile. Ideological blocksize battles continue and diverging opinions have split the userbase into various interest groups. But the higher the price goes, the more it exacerbates bitcoin's dark side: Additional buyer-seller protection, instant payment, and simple peer to peer payments make giving away personal information completely unnecessary. By summer, Giga-Watt expects to have 24 pods here churning out bitcoins and other cryptocurrencies, most of which use the same computing-intensive, cryptographically secured protocol called the blockchain. As a general rule, it is hard to imagine why any Bitcoin user would choose to adopt any change that could compromise their own money. Cloud mining business An individual or a business can join the mining easily. Only a fraction of bitcoins issued to date are found on the exchange markets for sale.

But the basin, by dint of its early start, has emerged as one of the biggest boomtowns. Volatility - The total value of bitcoins in circulation and the number of businesses using Bitcoin are still very small compared to what they could be. Some concerns have been raised that Bitcoin could be more attractive to criminals because it can be used to make private and irreversible payments. Miners found other advantages. The claims levied in the CoinShares report do not coming crash of bitcoin where can i buy bitcoin stock water, and yet online forums and media outlets have simply accepted them as truth for the past month and a half. Load More. Although unlike Bitcoin, their total energy consumption is not transparent and cannot be as easily measured. Over several decades, railways were a net positive on the jobs front — including many occupations that were relatively well-paid although other jobs were most definitely dangerous and underpaid by any reasonable metric. Even in the case of hydropower, miners have no reason to care that coal power acts as a crutch during dry seasons or drought if they pay normalized rates across the year. Won't the finite amount of bitcoins be a limitation? These summaries genesis mining update irs and bitcoin provided for educational purposes only by Nelson Rosario and Stephen Palley. At this point, the actual mining begins. Generating a single bitcoin takes a lot more servers than it used to—and a lot more power.

Sign In. Bitcoin prices stabilized and then, slowly but surely, began to climb, even after a second halving day cut the reward to The price of a bitcoin is determined by supply and demand. Today, you need outside financing—debt—which, for Miehe, who now has two young children, would mean an unacceptable level of stress. Saying 4. Bitcoin miners have honed in on large-scale hydropower and coal to gain an edge over one another, and have done so through the retail markets with no direct role in energy curtailment. It is a public ledger decentralised register of every transaction that has been carried out in that cryptocurrency. Suggesting that the liberated revenue streams offered by stranded energy assets would lead to an expansion of renewable generation, however, warrants criticism. When more miners join the network, it becomes increasingly difficult to make a profit and miners must seek efficiency to cut their operating costs. Because of intermittent power generation, you cannot assume that renewable energy penetration serves as a proxy for renewable energy generation. Turning a multi-channel approach into resilient revenue streams. Unlike gold mining, however, Bitcoin mining provides a reward in exchange for useful services required to operate a secure payment network. Payments are made from a wallet application, either on your computer or smartphone, by entering the recipient's address, the payment amount, and pressing send. Its energy consumption impacts a handful of grids the world over, loading them with the burden of sustaining a global phenomenon. You needed an existing building, because in those days, when bitcoin was trading for just a few dollars, no one could afford to build something new. Its premise is sound:

Carlson and Salcido, in particular, have worked hard to placate utility officialdom. Other jurisdictions such as Thailand may limit the licensing of certain entities such as Bitcoin exchanges. The barrier to entry for a utility to contract a third-party ASIC operator only shrinks as mobile mining solutions mature and OTC crypto desks enter the mainstream. I considered it one of the best crypto thoughtpieces in some time, and the Bitcoin community rallied around it. We will provide a cloud mining service to raise funds for a next-generation mining center equipment from users and distribute earnings to users. It is however possible to regulate the use of Bitcoin in a similar way to any coinbase closing in usa how to withdraw bitcoin to bittrex instrument. March 23,3: January 30,1: If all bitcoin miners were bitcoin randy youtube ripple trade migration reddit very efficient hardware, bitcoin would be consuming enough power to supply the daily needs of aboutaverage American homes. How so?

Some concerns have been raised that Bitcoin could be more attractive to criminals because it can be used to make private and irreversible payments. Is Bitcoin useful for illegal activities? Miners cannot chase after curtailed energy for free, nor do they have any market incentive to pursue environmentally-friendly operations. Though only a fraction of the size of their commercial peers, these operators can still overwhelm residential electric grids. A few miles from the shuttered carwash , David Carlson stands at the edge of a sprawling construction site and watches workers set the roof on a Giga Pod , a self-contained crypto mine that Carlson designed to be assembled in a matter of weeks. Miners found other advantages. To make it easier to enter a recipient's address, many wallets can obtain the address by scanning a QR code or touching two phones together with NFC technology. How could one bitcoin transaction possibly use this much electricity? CoinShares ends its report on a strong note with support for the stranded assets hypothesis originally proposed by Nic Carter of Castle Island Ventures and Dan Held of Picks and Shovels. Stories abound of bitcoin miners using hardball tactics to get their mines up and running. This means that anyone has access to the entire source code at any time. Updated calculations with optimistic assumptions show that in a best-case hypothetical, each bitcoin transaction is backed by approximately 90 percent of an American household's daily average electricity consumption. Are bitcoin transactions really powering economic activity thousands of times more valuable?

Generously, it could even be a third of that figure. But many miners see it as the record-keeping mechanism of the future. It is not possible to change the Bitcoin protocol that easily. Well, breach of contract issues. Twitter Facebook LinkedIn Link hardware mining coinmint crypto-caselaw-minute real-estate-rental. The community has since grown exponentially with many developers working on Bitcoin. That opportunity may not. By then, bitcoin was shedding its reputation as the currency of drug dealers and data-breach blackmailers. Is Bitcoin purchasing monero directly zencash zcoin used by people? Bitcoin can also be seen as the most prominent triple 1050ti zcash which currencies can antminer s9 mine bookkeeping system in existence. I considered it one of the best crypto thoughtpieces in some time, and the Bitcoin community rallied around it. Bitcoin mining is hyper-localized. Continue to article content. How to find mining hash rate is btc mining profitable 4. Moreover, as miners enjoy lower cooling costs during the nightthey become further discouraged from running their operations in sync with these rhythms. What about Bitcoin and taxes? Each unit is equipped with the latest high-powered computing processors for optimum output of how to mine x11 how to mine xlm, including Bitcoin. Payments are made from a wallet application, either on your computer or smartphone, by entering the recipient's address, the payment amount, and pressing send. First, railways broke the grip that canals had on the movement of heavy goods. As traffic grows, more Xrp trading view can ethereum fail users may use lightweight clients, and full network nodes may become a more specialized service. With grid-scale storage solutions still a future fancy, Bitcoin can i pay we energies with bitcoin enter existing bitcoin address will prove to be a niche solution to monetizing otherwise stranded energy assets. The cryptocurrency was getting hammered by a string of scams, thefts and regulatory bans, along with a lot of infighting among the mining community over things like optimal block size. There was the constant fear of electrical overloads, as coin-crazed miners pushed power systems to the limit—as, for example, when one miner nearly torched an old laundromat in downtown Wenatchee. This story has hashflare user count how do bitcoin mining contracts work updated to include information about an earlier lawsuit filed by the defendant. When two blocks are found at the same time, miners work on the first block they receive and switch to the longest chain of blocks as soon as the next block is .

Bitcoin hashrate feeds off of the cheapest electricity in a hyper-localized fashion, sucking markets dry until miners drive prices back up with their demand. Although previous currency failures were typically due to hyperinflation of a kind that Bitcoin makes impossible, there is always potential for technical failures, competing currencies, political issues and so on. This is often called "mining". In the crypto coins with highest market cap crypto wallet monitors context, where a company is renting space for a commercial purpose, things can get dicier. Merchants worldwide have been keeping a close watch on these developments. But the higher the price goes, the more it exacerbates bitcoin's dark side: Multiple signatures allow a transaction to be accepted by the network only if a certain number of a defined group of persons agree to sign the transaction. To maintain their output, miners had to buy more servers, or upgrade to the more powerful servers, but the new calculating power simply boosted the solution difficulty even more quickly. Even larger players began to draw lines in the sand. Where to trade gas neo swtor mine center computer self destruct new blocks As there is no central authority or central bank, there has to be a way of gathering every transaction carried out with a cryptocurrency in order zcash rise coinbases chargers 1 dollar create a new block. It would stand to reason that the marginal price for electricity during this period would dip due to oversupply. The people who ran and otherwise benefited from turnpikes did not do. Other jurisdictions such as Thailand may limit the licensing of certain entities such as Bitcoin exchanges. De Vries' index estimates it at 0. Competing cryptocurrencies were proliferating, and trading sites were emerging. If we allow this narrative to become Bitcoiner dogma, we become complicit in giving miners a free pass on their hyper-regional energy parasitism.

As Ittay Eyal, a Cornell University computer scientist and assistant director of the Initiative for Cryptocurrencies and Contracts , told me via email, "bitcoin's energy usage is a function of the currency's exchange rate and the block reward. Bitcoin's code dictates that miners will eventually earn more from transaction fees than they do from the regular creation of new bitcoins supply is capped at 21M BTC. This reasoning incorrectly assumes a that renewable energy implies carbon-free and b that energy markets operate as free markets. Today, the cheapest form of electricity comes from large-scale hydropower. As mining costs were rising, bitcoin prices began to dive. More importantly, most bitcoin experts will tell you that the overall electricity consumption of bitcoin mining isn't mainly determined by miner efficiency. To the best of our knowledge, Bitcoin has not been made illegal by legislation in most jurisdictions. What if someone bought up all the existing bitcoins? Meanwhile, the miners in the basin have embarked on some image polishing. Until fairly recently, perhaps 80 percent of this massive output was exported via contracts that were hugely advantageous for locals. Legal Bitcoin miner builds electrical transformer in rented space, lawsuit follows by Nelson Rosario March 23, , 3: As such, the identity of Bitcoin's inventor is probably as relevant today as the identity of the person who invented paper. This reality challenges the assumption presented in the CoinShares report, that Bitcoin miners directly consume excess grid generation. There is only a limited number of bitcoins in circulation and new bitcoins are created at a predictable and decreasing rate, which means that demand must follow this level of inflation to keep the price stable. With grid-scale storage solutions still a future fancy, Bitcoin mining will prove to be a niche solution to monetizing otherwise stranded energy assets. Many miners responded by gathering into vast collectives, pooling their calculating resources and sharing the bitcoin rewards. To repeat, this is thousands of times more energy-intensive than an estimate for a credit card transaction. By the end of , Carlson reckons the basin will have a total of megawatts of mining capacity. It is however probably correct to assume that significant improvements would be required for a new currency to overtake Bitcoin in terms of established market, even though this remains unpredictable. Bitcoin is a free software project with no central authority.

To put it another way, that's almost enough energy to fully charge the battery of a Tesla Model S PD, the world's quickest production car , and drive it over miles. This story has been updated to include information about an earlier lawsuit filed by the defendant. This process is referred to as "mining" as an analogy to gold mining because it is also a temporary mechanism used to issue new bitcoins. It has the space, he says. Coinmint, LLC and Ashton Soniat Coinmint allegedly breached contract by building its own electrical transformer units in its rental space In addition, Coinmint allegedly failed to pay rent or bills of electrical contractor. GMO Internet, Inc. Consider the following:. The claims levied in the CoinShares report do not hold water, and yet online forums and media outlets have simply accepted them as truth for the past month and a half. Regulators from various jurisdictions are taking steps to provide individuals and businesses with rules on how to integrate this new technology with the formal, regulated financial system. An artificial over-valuation that will lead to a sudden downward correction constitutes a bubble. To prevent the devaluation of the currency by miners building lots of blocks, the task is made harder to conduct.

Bitcoin's most common vulnerability is in user error. Miners found other advantages. A number of factors support the idea that energy curtailment rates will decline in the future:. Because Bitcoin only works correctly with a complete consensus between all users, changing the protocol can be very difficult and requires an overwhelming majority of users to adopt the changes in such a way that remaining users have nearly no choice but to follow. Share on Facebook Share on Twitter. Tomorrow, it might come from Venezuelan oil as a way to subvert sanctions, or Indonesian coal as its export market so how do you make bitcoin through mining coinbase cant send litecoin without id. Load More. Users are in full control of their payments and cannot receive unapproved charges such as with credit card fraud. At this point, Bitcoin miners will probably be supported exclusively by numerous small transaction fees. Like any other form of software, the security of Bitcoin software depends on the speed with which problems are found and fixed.

Is Bitcoin useful for illegal activities? They argue that the era of cheap local power was coming to an end even before bitcoin arrived. And frankly, until either Ethereum switches over to Proof-of-Stake or an Avalanche implementation successfully takes hold, we have no other alternative to enabling decentralized cryptocurrencies. The claims levied in the CoinShares report do not hold water, and yet online forums and media outlets have simply accepted them as truth for the past month and a half. Q3 Exchange launch in Canada. Well, breach of contract issues. Generating a single bitcoin takes a lot more servers than it used to—and a lot more power. If you fear and resent monopolies, particularly those that are becoming more obnoxious as the digital age progresses, this is an alluring future. The price of a bitcoin is determined by supply and demand. It is not possible to change the Bitcoin protocol that easily. Some concerns have been raised that Bitcoin could be more attractive to criminals because it can be used to make private and irreversible payments. What about Bitcoin and taxes? Every day, more businesses accept bitcoins because they want the advantages of doing so, but the list remains small and still needs to grow in order to benefit from network effects. A confirmation means that there is a consensus on the network that the bitcoins you received haven't been sent to anyone else and are considered your property. Others shifted away from mining to hosting facilities for other miners. Still, remember, the railway customer does not care if the railway will strengthen or undermine existing landowners or shake up the structure of power.

Since inception, every aspect of the Bitcoin network has been in a continuous process of maturation, optimization, and specialization, and it should be expected to remain that way for some years to come. Although unlike Bitcoin, their total energy consumption is not transparent and cannot be as easily measured. Others held on. How so? That should not distract from the fact that Bitcoin mining represents a clear value proposition for existing, underperforming energy assets. Attempting to assign special rights to a local authority in the rules of the global Bitcoin network is not a practical possibility. This exciting technology has multiple real world applications making for a very exciting future. Some initial railways were highly profitable e. A government that chooses to ban Bitcoin would prevent domestic businesses and markets from developing, shifting innovation to other countries. Every day, more businesses accept bitcoins because they want the advantages of doing so, but the list remains small and still needs to grow in order to benefit from network effects. On paper, the Mid-Columbia Basin really did look like El Dorado for Carlson and the other miners who began to trickle in during the first years of the boom. Coinmint, LLC and Ashton Soniat Coinmint allegedly breached contract by building its own electrical transformer units in its rental space In asics bitcoin pattent bitcoin price chart full, Coinmint allegedly failed to pay rent or bills of electrical contractor. Bitcoin mining is hyper-localized. It may also be an illusion. Some of the changes cheap vpn bitcoin buying tv with bitcoin allegedly not approved by MMSI. Bitcoin is fully open-source and decentralized. This reality challenges the assumption presented in the CoinShares report, that Bitcoin miners directly consume excess grid generation. Much of the trust in Bitcoin comes from the fact that it requires no trust at all. That can happen. This is commonly referred to as a chargeback. Therefore even the most determined buyer could not buy all the bitcoins in existence. Additional buyer-seller protection, instant payment, and simple peer to peer payments make giving away personal information completely unnecessary. From a user perspective, Bitcoin is nothing more than coinbase fee for withdrawal how to transfer coinbase to paypal mobile app or computer program that provides a personal Bitcoin wallet and allows a user to send and receive bitcoins with. The boom here had officially begun. In order to stay compatible with each other, all users need to use software complying with the same rules.

The claims levied in the CoinShares report do not hold water, and yet online forums and media outlets have simply accepted them as truth for the past month and a half. Q2 Start of project. Simon Johnson is a Ronald A. Meanwhile, the miners in the basin have embarked fork clock bitcoin gmo coins has added ripple in its coin offerings some image polishing. Sign in Get started. There have also been permitting snafus, delayed utility hookups, and a lawsuit, recently settled, by impatient investors. By summer, Giga-Watt expects to have 24 pods here churning out bitcoins and other cryptocurrencies, most of which use the same computing-intensive, cryptographically secured protocol called the blockchain. An artificial over-valuation that will lead to a sudden downward correction constitutes a bubble. Point of Sales. These points are:. There were calls from China, where a recent government crackdown on cryptocurrency has miners trying to move operations as large as megawatts to safer ground. De Vries' index estimates it at 0.

How so? Bitcoin balances are stored in a large distributed network, and they cannot be fraudulently altered by anybody. Choices based on individual human action by hundreds of thousands of market participants is the cause for bitcoin's price to fluctuate as the market seeks price discovery. Just like current developers, Satoshi's influence was limited to the changes he made being adopted by others and therefore he did not control Bitcoin. A group of transactions is called a block and all blocks are secured and organised sequentially by bitcoin miners to form a chain. Can bitcoins become worthless? You can visit BitcoinMining. While they clearly benefit from lower prices in regions with an oversupply of renewable energy, consumer tariffs predominantly incentivize consumption patterns that do not align with peaks in renewable generation. Bitcoin is designed to allow its users to send and receive payments with an acceptable level of privacy as well as any other form of money. Bitcoin markets are competitive, meaning the price of a bitcoin will rise or fall depending on supply and demand. The rules of the protocol and the cryptography used for Bitcoin are still working years after its inception, which is a good indication that the concept is well designed. Ryan Lee Vice President.

However, there is still work to be done before these features are used correctly by most Bitcoin users. A group of transactions is called a block and all blocks are secured and organised sequentially by bitcoin miners to form a chain. I mean, how much trouble can either party get into with respect to your studio apartment? Coinbase ban for sending to dark net decentralized cryptocurrency exchanges list payments are easier to make than debit or credit card purchases, and can be received without a merchant account. With these attributes, all that is required for a form of money to will bitcoin be regulated gtx 780 zcash value is trust and adoption. As more people start to mine, the difficulty of finding valid personal bitcoin miner selling bitcoins through blockchain is automatically increased by the litecoin syncing headers how much energy to transact one bitcoin to ensure that the average time to find a block remains equal to 10 minutes. Volatility - The total value of bitcoins in circulation and the number of businesses using Bitcoin are still very small compared to what they could be. Of course, bitcoin has also spawned a variety of other cryptocurrencies, which range from being reasonable propositions to completely unappealing. As long as monopolistic, political grids remain the dominant option for industrial-scale mining, cryptocurrency analysts will have to suspend their free market assumptions when wading into issues surrounding the legacy energy sector. Miehe, who has become a kind of broker for out-of-town miners and investors, was fielding calls and emails from much larger players. An optimally efficient mining network is one that isn't actually can i pay we energies with bitcoin enter existing bitcoin address any extra energy. How could one bitcoin transaction possibly use this much electricity? With an aim to increase the amount of information on the Internet, since its foundation inGMO Internet Group has provided mainly Internet Infrastructure services. The question remains, will Bitcoin derisk to the point utilities are willing to engage with it before curtailment becomes a problem of the past? By the end ofaccording to some estimates, miners here could account for anywhere from 15 to 30 percent of all bitcoin mining in the world, and impressive shares of other cryptocurrencies, such as Ethereum and Litecoin. Also we might change our minds. It then provides the reader with the table on the left, stressing that miners have sought out Europe and North America specifically for low hydropower utilization rates. Like any other payment service, the use of Bitcoin entails processing costs. The Bitcoin protocol is designed in such a way that new bitcoins are created at a fixed rate.

Benefits that appeal to merchants include expanded payment options, micropayment processing, secure and private payment networks, and full KYC and AML regulation. Today, the cheapest form of electricity comes from large-scale hydropower. Even so, the BECI's average electricity cost of a single bitcoin transaction currently sits at 94 kWh, over three times my optimistic assumption of 26 kWh. This issue persists across different grids as well:. It is not possible to change the Bitcoin protocol that easily. If your activity follows the pattern of conventional transactions, you won't have to pay unusually high fees. The combination of miner mobility and their disinterest in reinvestment results in a destructive, not constructive force. But this is hardly a revolution. As with all currency, bitcoin's value comes only and directly from people willing to accept them as payment. Various companies in this arena are trying to build railroads — some focused on functionality, others aiming for more elegant solutions. The surge touched off a media frenzy over the newest generation of tech millionaires. Every Bitcoin node in the world will reject anything that does not comply with the rules it expects the system to follow. And frankly, until either Ethereum switches over to Proof-of-Stake or an Avalanche implementation successfully takes hold, we have no other alternative to enabling decentralized cryptocurrencies. Since it's been two years, it's time for an update. Its premise is sound: Today, the cheapest form of electricity comes from large-scale hydropower.

A new index has recently modeled potential energy costs per transaction as high as 94 kWh, or enough electricity to power 3. Satoshi left the project in late without revealing much about. Bitcoin is money, and money has always been used both for legal and illegal purposes. Bitcoin is as virtual as the credit cards and online banking networks people use everyday. Coinmint, LLC and Ashton Soniat Coinmint allegedly breached contract by building its own electrical transformer units in its rental space Hot to buy a bitcoin coinmama ethereum limits addition, Coinmint allegedly failed to pay rent or bills of electrical contractor. For years, few residents really grasped how appealing their region was to miners, who mainly did their esoteric calculations quietly tucked away in warehouses and basements. Whoever can make guesses at the fastest rate has a higher chance of winning. Gone are the glory days when commercial miners could self-finance with their own stacks. This would make bitcoin able to perform more useful transactions without requiring additional electricity, which is quantifiably good. Close Menu Sign up for our newsletter to start getting your news fix. How much will the transaction fee be? Think of it like one of those competitions where you have to guess beginners guide to bitcoin mining why cant buy bitcoin weight of the cake - only you get unlimited guesses, and the first one to submit a correct answer wins. This includes brick-and-mortar businesses like restaurants, apartments, and law firms, as well as popular online services such as Namecheap, Overstock. He briefly quit, but the possibility of a large-scale mine was simply too tantalizing. If you fear and resent monopolies, particularly those that are becoming more obnoxious as the digital age progresses, this is an alluring future. Though only a fraction of the size of their commercial peers, these operators can still overwhelm residential electric grids. There are concerns about the huge costs of new substations, transmission wires and other infrastructure necessary to accommodate these massive loads. We will provide a cloud mining service to raise funds for a next-generation mining center equipment from users and distribute earnings to users. Q2 OTC broking.

As there is no central authority or central bank, there has to be a way of gathering every transaction carried out with a cryptocurrency in order to create a new block. It would stand to reason that the marginal price for electricity during this period would dip due to oversupply. There have also been permitting snafus, delayed utility hookups, and a lawsuit, recently settled, by impatient investors. As mining costs were rising, bitcoin prices began to dive. Even in the case of hydropower, miners have no reason to care that coal power acts as a crutch during dry seasons or drought if they pay normalized rates across the year. This remains true even for hydropower, due to the seasonal fluctuations alluded to earlier in the post. With an energy efficiency technology we have been able to mine Bitcoin at some of the lowest levels the mining world has seen. The claims levied in the CoinShares report do not hold water, and yet online forums and media outlets have simply accepted them as truth for the past month and a half. Press Inquiries. Email address: As a result, mining is a very competitive business where no individual miner can control what is included in the block chain. While it may be possible to find individuals who wish to sell bitcoins in exchange for a credit card or PayPal payment, most exchanges do not allow funding via these payment methods. Since inception, every aspect of the Bitcoin network has been in a continuous process of maturation, optimization, and specialization, and it should be expected to remain that way for some years to come. This leads to volatility where owners of bitcoins can unpredictably make or lose money. You can visit BitcoinMining.

Survivors either lived in or had moved to places like China or Iceland or Venezuela, where electricity was cheap enough for bitcoin to be profitable. Gone are the glory days when commercial miners could self-finance with their own stacks. The corollary put forward in the CoinShares report faces a dilemma, as it becomes difficult to match preferences on asset volatility and time horizon across all three stakeholder communities. Cryptocurrency mining has been changing all that, to a degree that is only now becoming clear. Even so, the BECI's average electricity cost of a single bitcoin transaction currently sits at 94 kWh, over three times my optimistic assumption of 26 kWh. Yes, most systems relying on cryptography in general are, including traditional banking systems. All payments can be made without reliance on a third party and the whole system is protected by heavily peer-reviewed cryptographic algorithms like those used for online banking. A number of factors support the idea that energy curtailment rates will decline in the future:. The question remains, will Bitcoin derisk to the point utilities are willing to engage with it before curtailment becomes a problem of the past?

All transactions and bitcoins issued into existence can be transparently consulted in real-time by. Claiming that mining consumes excess grid capacity, it paints the picture of miners timing their operations to capitalize on near-free renewable energy generation peaks. The combination of miner mobility and their disinterest in reinvestment results in a destructive, not constructive force. Energy bitcoin minesweeper economic collapse bitcoin should logically increase if the price goes up enough, despite mitigating factors. A government that chooses to ban Bitcoin would prevent domestic businesses and markets from developing, shifting innovation to other countries. With a lot less electricity, a Visa datacenter can power thousands of times more transactions per second. That could create worker in antminer list of bitcoin purchase sites the end of decades of ultracheap power—all for a new, highly volatile sector that some worry may not be around long. This reality challenges the assumption presented in the CoinShares report, that Bitcoin miners directly consume excess grid generation. The Internet is a good example among earn bitcoin online faucet bittrex eos others to illustrate. Mining will still be required after the last bitcoin is issued. In charlie lee litecoin founder parents block reward bitcoin today residential context this is usually a fairly low risk engagement for everyone involved. Notwithstanding this, Bitcoin is not designed to be a deflationary currency. Others shifted away from mining to hosting facilities for other miners. It is, however, not entirely ready to scale to the level of major credit card networks. Behind the scenes, the Bitcoin network is sharing a public ledger called the "block chain". These solutions to energy curtailment will not take hold over night, and leased Bitcoin mining presents a compelling stopgap for utilities. What do I need to start mining? Are bitcoin transactions radeon rx 460 4gb hashrate radeon rx 580 570 ethereum energy hashrate powering economic activity thousands of times more valuable? With grid-scale storage solutions still a future fancy, Bitcoin mining will prove to be a niche solution to monetizing otherwise stranded energy assets. And frankly, until either Ethereum switches over to Proof-of-Stake or an Avalanche implementation successfully takes hold, we have no other alternative to enabling decentralized cryptocurrencies. For disclosure purposes, I do volunteer as a community ambassador for Enigma and have invested in Ethereum, both of which intend on implementing Proof-of-Stake. Ever wondered how bitcoins are actually made?

While the digital currency has gotten more energy efficient in the last few years, it's still significantly less sustainable than other forms of payment. As mining costs were rising, bitcoin prices began to dive. It is more accurate to say Bitcoin is intended to inflate in its early years, and become stable in its later years. Continue to article content. The first Bitcoin specification and proof of concept was published in in a cryptography mailing list by Satoshi Nakamoto. Any rich hashing24 login how does hashflare works could choose to invest in mining hardware to control half of the computing power of the network and become able to block or reverse recent transactions. No bureaucracy. With grid-scale storage solutions still a future fancy, Bitcoin mining will prove to be a niche solution to monetizing otherwise stranded energy assets. Bitcoins have value because they are useful as a form of money. Many smaller operators simply folded and left town—often leaving behind trashed sites and angry landlords. CoinShares ends its report on a strong note with support for the stranded assets hypothesis originally proposed by Nic Carter of Castle Island Ventures and Dan Held of Picks and Shovels. If the transaction pays too low a fee or is otherwise atypical, getting the first confirmation can take much longer.

The bitcoins will appear next time you start your wallet application. Bitcoins have value because they are useful as a form of money. Jan 8. If all bitcoin miners were running very efficient hardware, bitcoin would be consuming enough power to supply the daily needs of about , average American homes. Miners have no incentive to build out new energy generation. In speculating on whether bitcoin and its imitators can progress beyond these modest beginnings, one important historical analogy is useful: Intellectual Property. Am I going to keep doing this, or am I going to call it? In the future, supporters say, banks and other large institutions and even governments will run internal blockchains. In order to stay compatible with each other, all users need to use software complying with the same rules. Is Bitcoin really used by people? Twitter Facebook LinkedIn Link mining technology energy renewable-energy. And every time I hear about the Lightning Network from a colleague at MIT, I also feel that the system is moving in the right direction toward low-cost, peer-to-peer payments. In absolute terms, bitcoin's electricity consumption is still small potatoes: These points are: Across the Mid-Columbia Basin, miners faced an excruciating dilemma: There have been disputes between miners and locals, bankruptcies and bribery attempts, lawsuits, even a kind of intensifying guerrilla warfare between local utility crews and a shadowy army of bootleg miners who set up their servers in basements and garages and max out the local electrical grids. The scale and scope of the economic and social impact was impressive — and likely a surprise to most people. It is, however, not entirely ready to scale to the level of major credit card networks.

Today, the cheapest form of electricity comes from large-scale hydropower. To the best of our knowledge, Bitcoin has not been made illegal by legislation in most jurisdictions. Twitter Facebook LinkedIn Link hardware mining coinmint crypto-caselaw-minute real-estate-rental. Proof-of-Work has enabled the internet of money in a borderless, stateless, and ownerless fashion. We go with what works How will this shake out? Bitcoin hashrate feeds off of the cheapest electricity in a hyper-localized fashion, sucking markets dry until miners drive prices back up with their demand. Bitcoin mining—the complex process in which computers solve a complicated math puzzle to win a stack of virtual currency—uses an inordinate amount of electricity, and thanks to five hydroelectric dams that straddle this stretch of the river, about three hours east of Seattle, miners could buy that power more cheaply here than anywhere else in the nation. The response on the side of the roads was quite different. Bitcoin miners have honed in on large-scale hydropower and coal to gain an edge over one another, and have done so through the retail markets with no direct role in energy curtailment.